I had a bad week. For me a bad week is measured in two ways. (1)How many families did I help? (2) Was I able to help my own family?

Now if you are savvy, you may have guessed that there is a strong correlation between how many families I can help and how much I’m helping my own family but you may be unaware of the underworkings of how I get paid and how much or how little getting paid may have to do with helping my family. To answer this latter question, I’ll need to focus a bit on what I value. Not all insurance agents have the same values. Some lack a good life-work balance. Some lack lasting marriages. And not all cherish or evaluate honesty and integrity the same way.

Here’s my story. I have a sort of Kantian belief that if everyone lied, the world would fall apart, whereas if everyone treated everyone else with kindness and honesty, not always serving themselves, that the world would be a much nicer place for everyone. Call me naive. Call me a dreamer. I don’t think about commissions much. I contract with as many carriers as I need to to provide the best value for as many families as possible. And I assume the money will follow. Eventually. Never lose faith in that.

But Is Aiming Wide and Long-Term a Shot in the Foot?

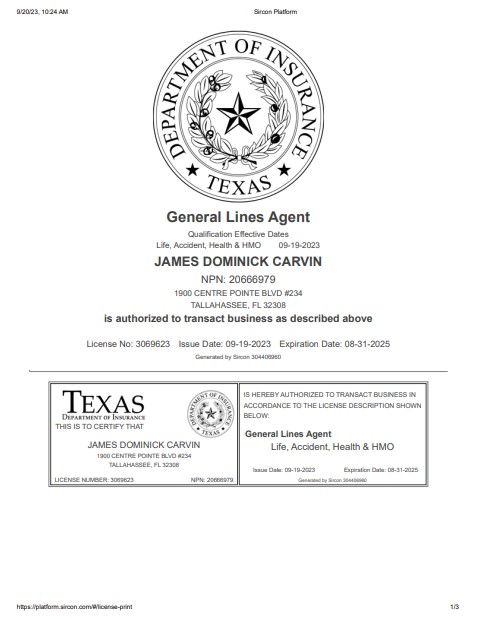

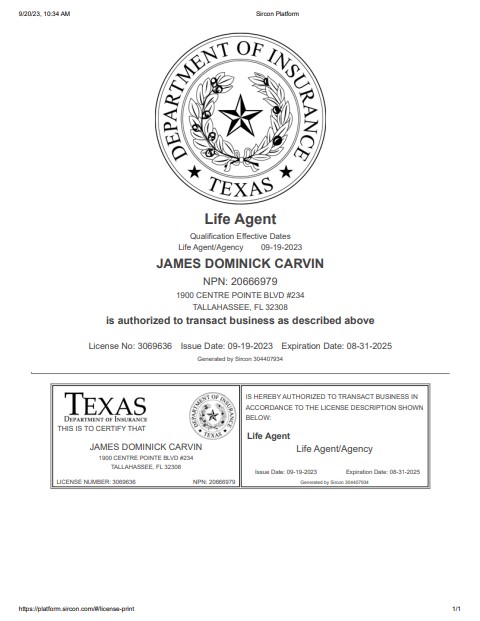

If you understand the insurance industry, you may understand how this sort of Kantian philosophy can be self-detrimental. Although it may be empowering, there are several ways in which contracting with too many carriers can be harmful to an agent. Firstly, every hour spent training is an hour taken away from selling. Contracting with many carriers and many types of products in many states is a long-term strategy. And it has a moving target, since carriers change their competitive edge with some frequency.

It’s also detrimental to a more efficient sales process. If efficiency was my top priority, I would stick with one area of expertise. I would either sell medicare or ACA, or hospital indemnity, or dental plans, or cancer, or accidental, or final expense, or IULs, or annuities, or health matching accounts, or group insurance – not all. (I do have multiple sources for all of those things in multiple states and much more).

If I was like most, I would have a store, not a mall, or a section of a store with just one demographic to target. I’d probably focus on life insurance, since that’s where the big up-front commissions are. And I sure wouldn’t become an expert in DSNPs.

I’ve spent days trying to help people get onto Medicaid, knowing they qualify, or on Medicare since they are on Medicaid but didn’t know Medicare came withb the disabity SSDI they were receiving. I’ve spent a lot of time teaching people how to access their social security accounts to access their Medicare numbers – only to find that they aren’t able to or won’t take the initiative to help themselves. A DSNP is a Dual Special Needs Plan. Use my abreviation chart if you see any acronyms you’re unfamiliar with. My plan is to be the ultimate source for training in all things insurance. Knowledge is power, but in the short term, it may not be practical to spend time gaining it.

Still, knowledge helps me to know how to fix things. I have a deep inner need to fix problems and the harder they are to fix the more determined I get to solve them. My friends, this sort of need is not compatible with efficiency and high volume sales. If I tell you that I’ve had a bad week, it probably means that I put in a great deal of effort to help people in desperate need of my help, but not only failed to meet that goal, but also took time away from my own family, not to mention the bills that I accrued both in my business and at home.

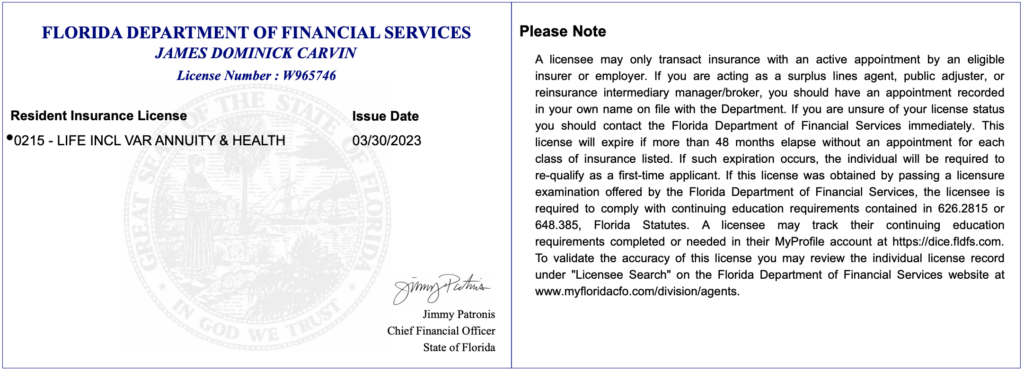

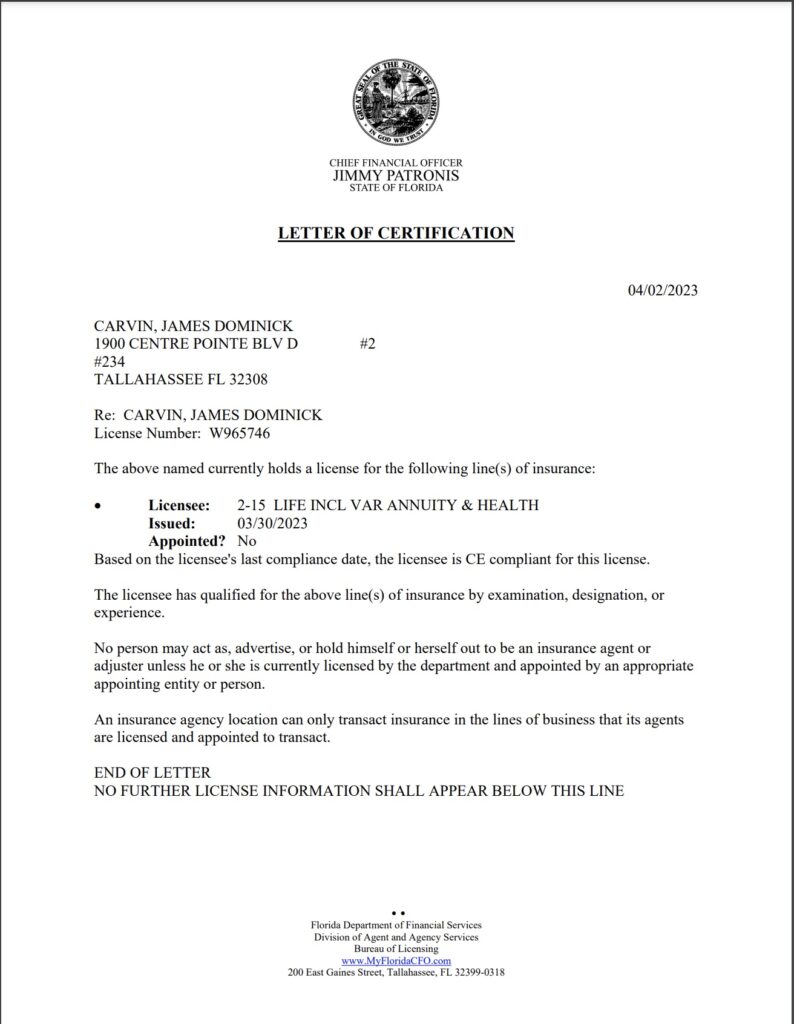

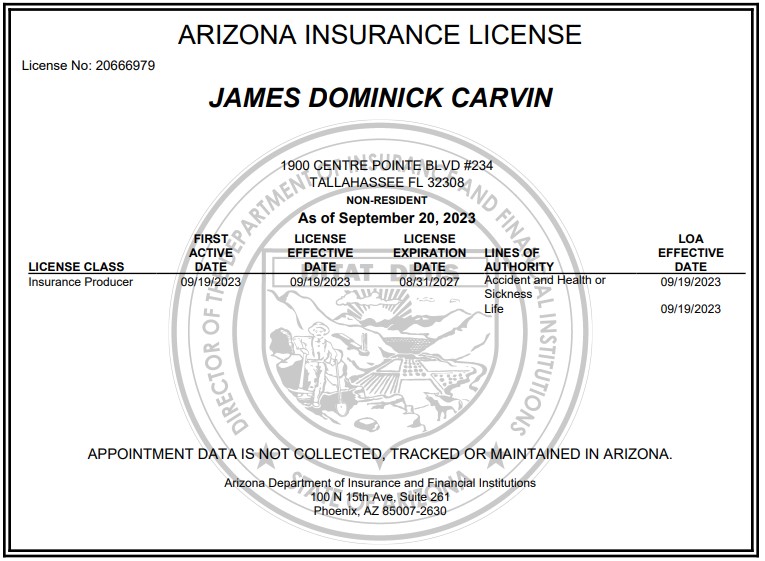

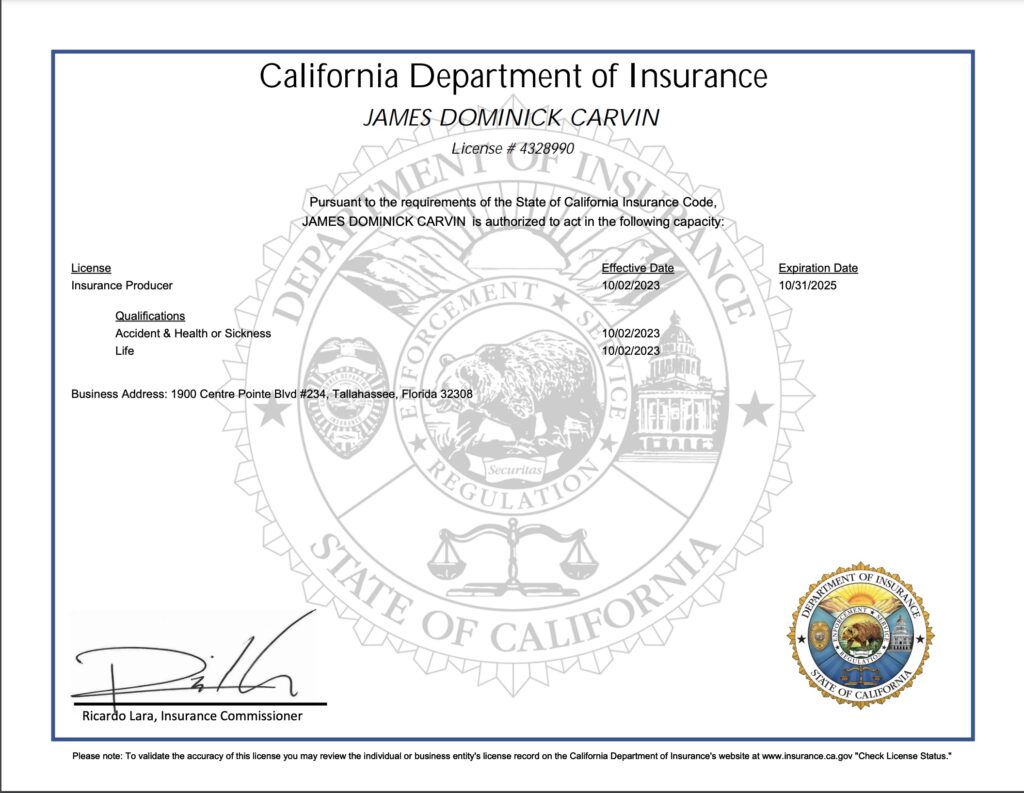

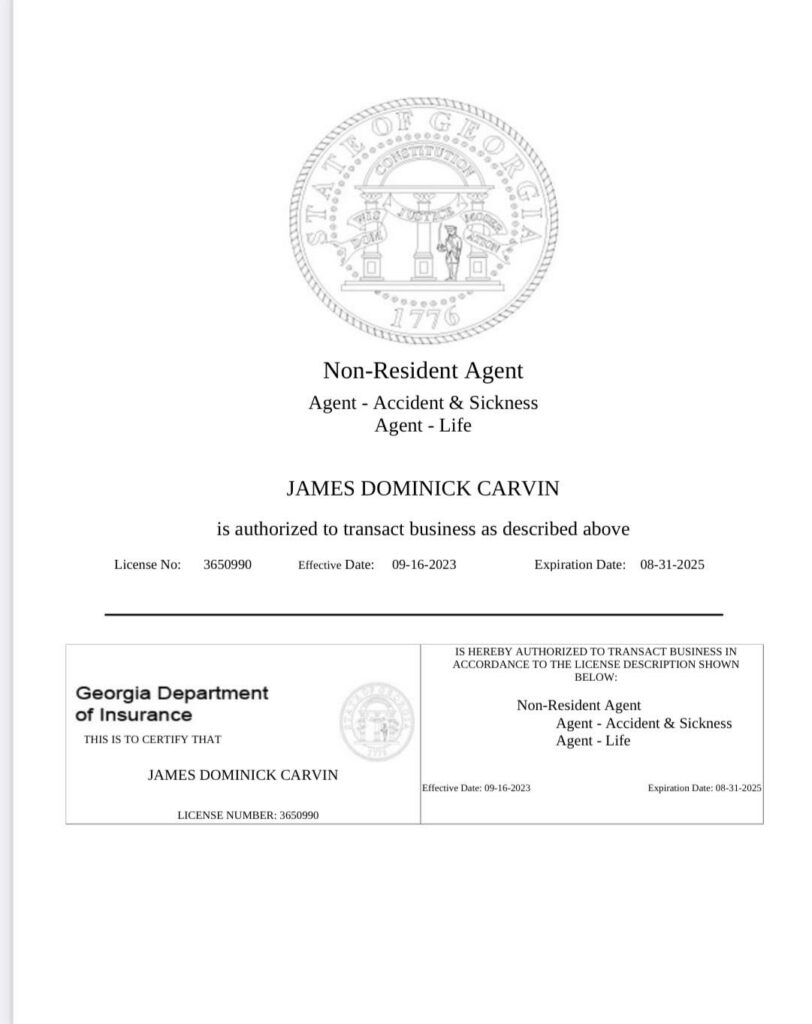

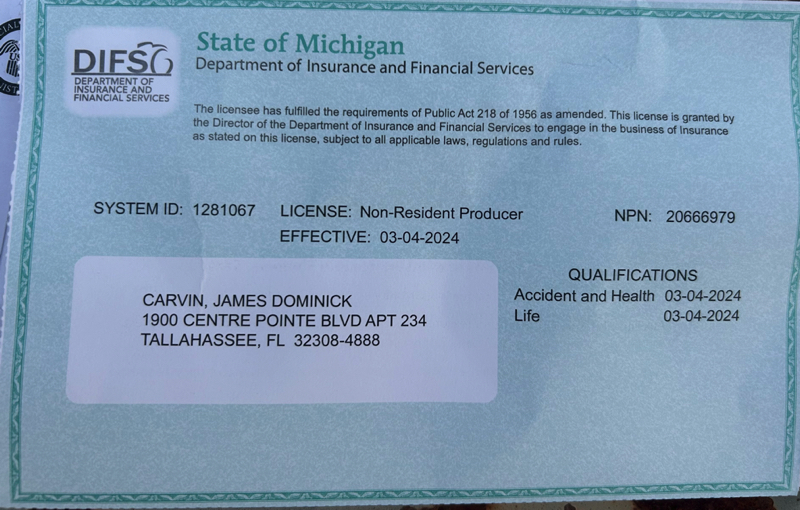

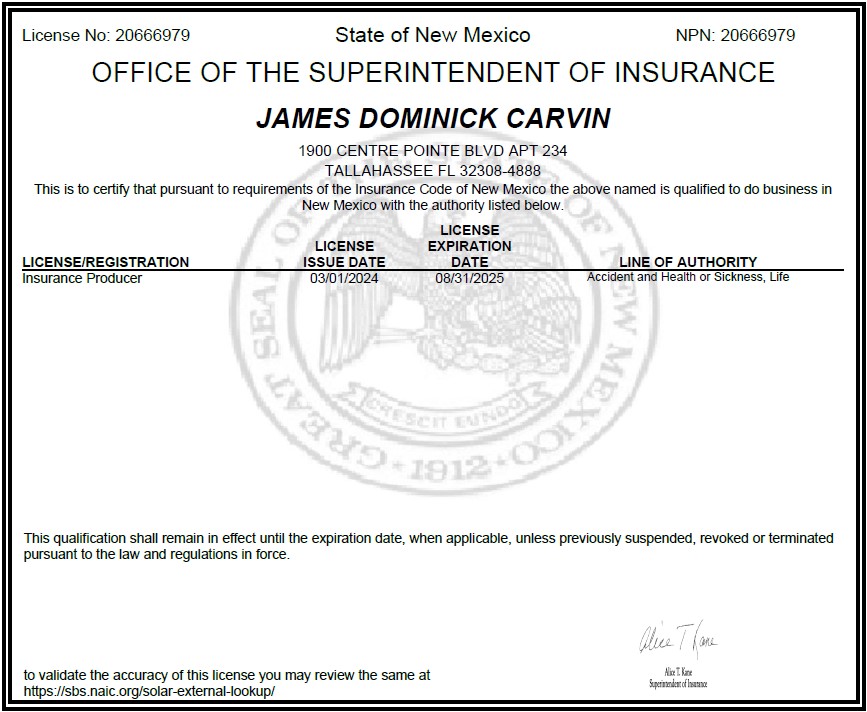

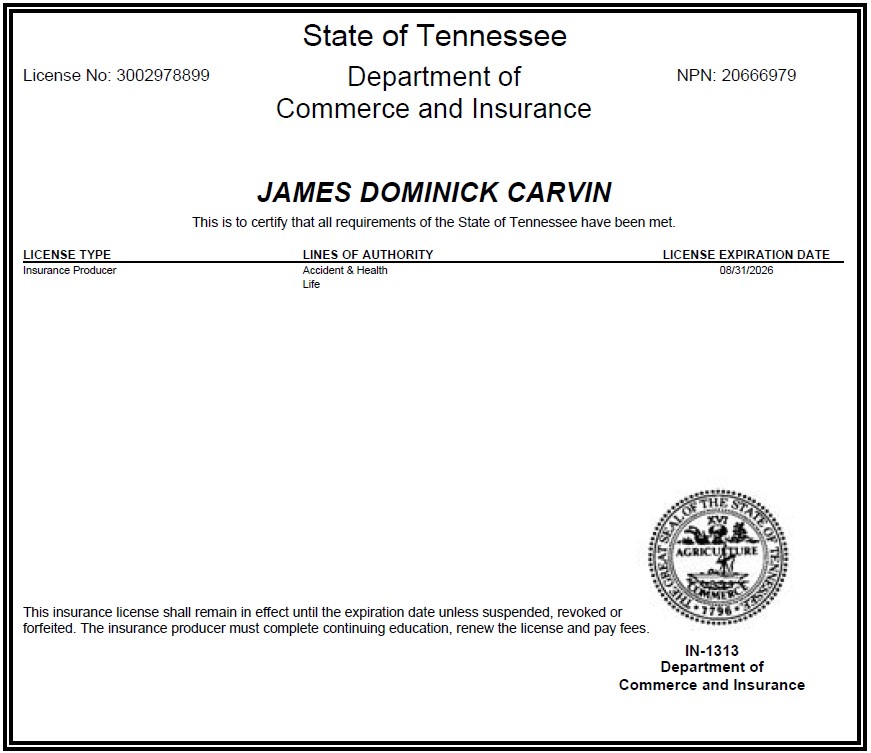

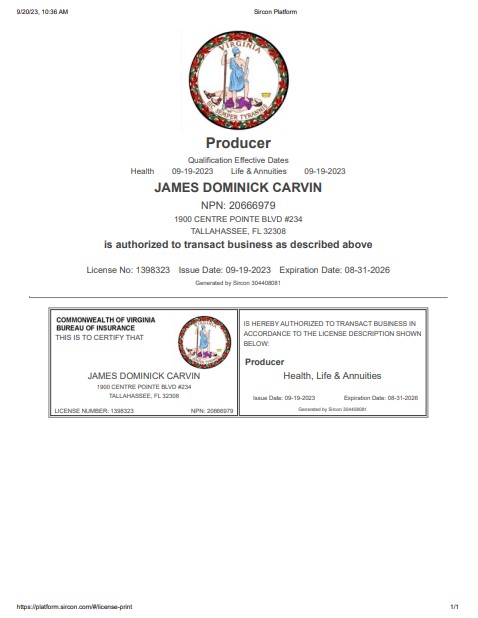

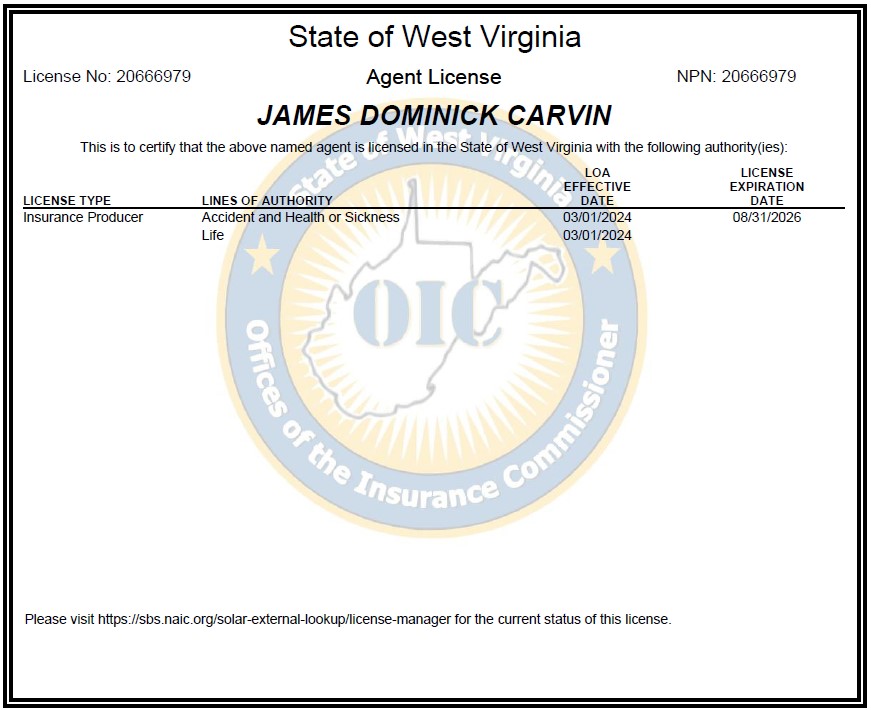

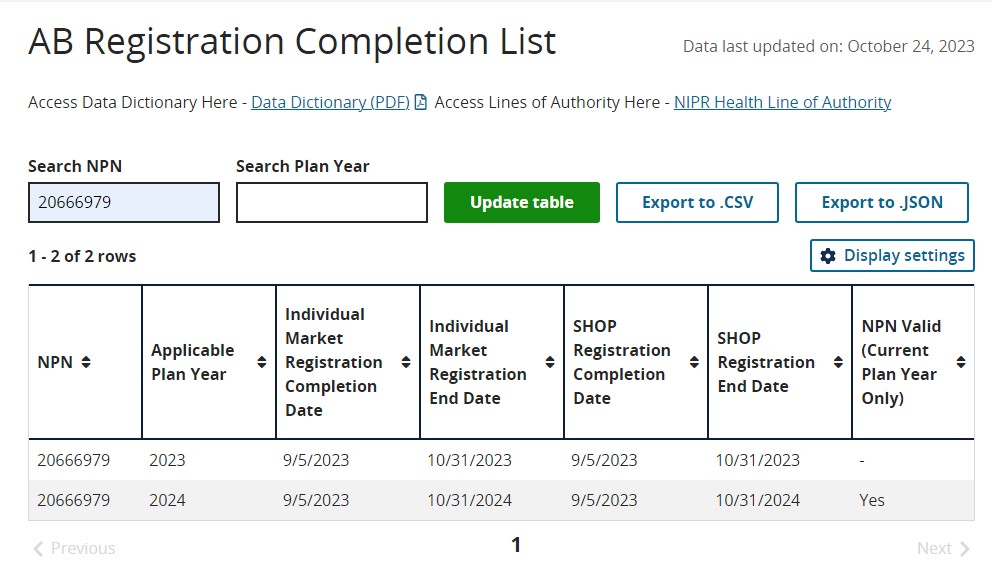

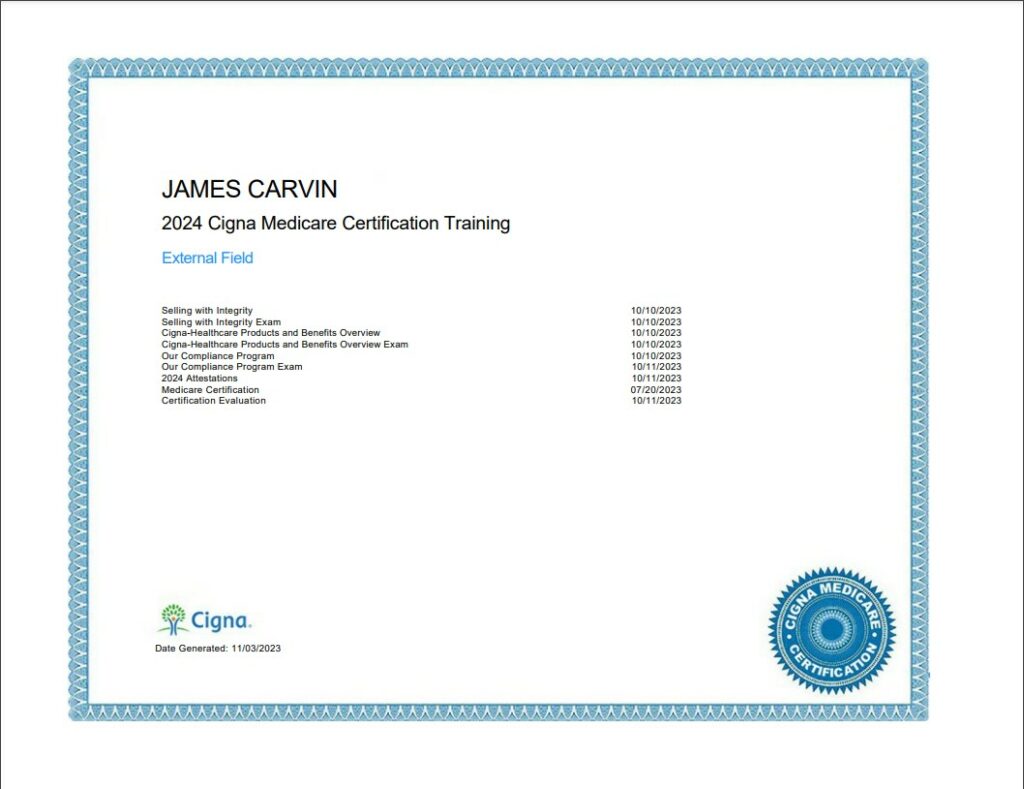

Have you ever wondered what it is like to be an insurance agent? Despite the presently very gloomy week I’ve been telling you about, it is actually a very lucrative career on average, especially if you do it the way the most successful agents do. And you don’t even need a college degree to get started. I could train you myself and show you the steps I took to get my own licenses. I’ve been turning myself into a human insurance encyclopedia. I could even offer practical advice about who to work with based on your personality type. I would be the first to tell you why my own personality type isn’t the best fit for certain types of insurance sales – at least not in the short term. I’ll explain.

A Tale of Two Personality Types

I love missions. I hate sales. Are you my type? I believe that if you do the right thing, the money will follow. I believe that if I do extra research for my clients so that I know with certainty they couldn’t possibly get more insurance for their dollar, that I’ll get as many referrals as I can handle, and that one day my referral business will be sufficient to end my need to ever pay for leads again. Does that resonate with you? Well, then you have what I call agent personality type one.

Then there is personality type two:

When you start in business, any business, not just the insurance business, if you’re not lucky enough to be a social media influencer, or if you don’t come loaded with startup cash to pay for a staff and an advertising agency, or pay for AI to do most of your work for you, or to organize a customer relations management system like SalesForce, then you are likely to do it the way I was told I should do it by the people who introduced me to this business. They are looking for people with personality type two. Only people with personality type two make a quick fortune in this business. The rest choose to leave the rat race. As a result, the majority of insurance agents do it their way. They are the only ones that last.

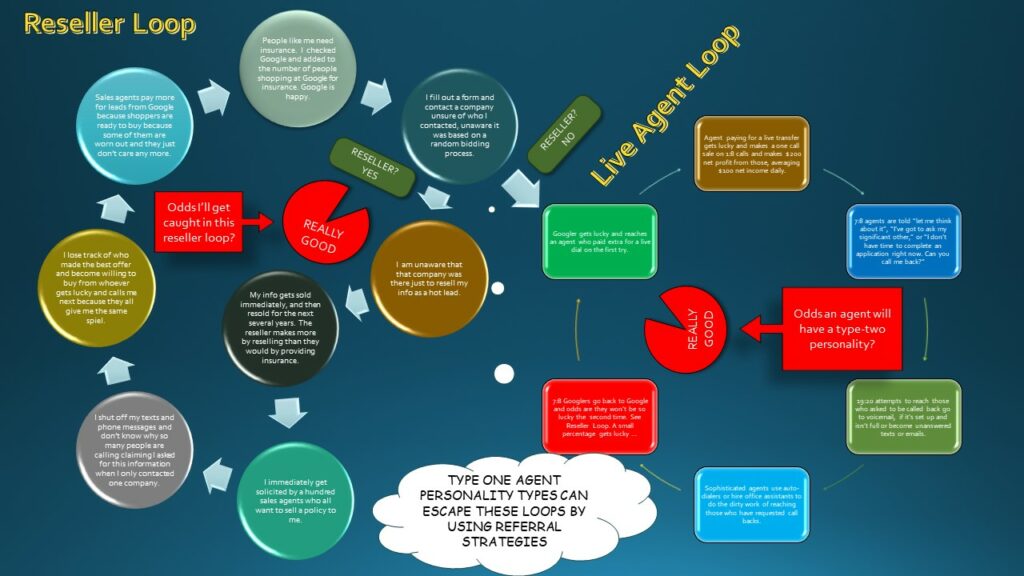

What is their way? I hate their way and it’s not how I want to spend my life. They pay a leads agency for leads. The cheapest leads go for about 50 cents. They are three years old or older. These leads have been sold and resold by Facebook, by Google, and by specialty agencies who bid for key words and take the same information and sell it over and over and over again.

There is nothing exclusive about these leads. They were generated by people like you and me who occasionally fill out a form we find online, usually on a trusted source, innocently enough – some ad we saw as we were scrolling through our favorite social media site, or from some active search we did. We probably cringed as we discovered we were being asked for our contact data in exchange for a quote or some hyped up piece of information that was probably too good to be true.

It really hurts, from my perspective, to find out that a $50 lead was actually from someone responding to an ad about free government money. Do I have to pay more than $50 to pay for someone who actually wants insurance?

Such people would have been smart to recognize it was too good to be true, and since the call went through, I can’t get a refund for the lead. And now it is too late. Too late for them and too late for me.

We’ve all done it. Our inbox, our text messenger, our phone, will receive dozens of messages daily for the forseeable future. We’ve learned to block it all, but it’s still a major nuisance in our life. Meanwhile, my business, on the receiving end, is ruined by it.

Sometimes, we actually want what someone is selling. Type two personalities count on that happening often enough. Some people are impulse shoppers. They count on that too.

Others of us are more methodical and like to compare and get the best value.

But all of us get worn out sooner or later. We don’t have the unlimited time or energy we need to do a thorough search. And once we see how the system works, we become fearful that the more places we check the more people we’ll have calling us. We hate callers, so we cut the shopping journey short even if we know we’re probably paying too much. This is what the type two agent personality depends on. They are comfortable calling people all day long if they can wear out enough people. They don’t feel bad about taking away a little from their quality of life by being the hundredth caller.

And from that weary prospect’s perspective, maybe just buying something and getting it all over with, will stop the endless stream of solicitations. But will actually buying the thing dozens of agents have been calling to sell us get the phone to stop ringing and the texts to stop pouring in? Not at all. So the type two agent’s call will be like a drop in the bucket. No harm, no foul.

Pullerama

I have a deep seated disdain for the fact that the reselling of leads is an American reality.

On the high end of the leads pricing scale is something called an exclusive lead, and at the tippy top, is the exclusive live-transfer lead. I pay $61 a piece for those. I get very specific information to show they were qualified and it is all ported over to me at the time of the call. To me, those are the only ethical leads to buy. The person has contacted me specifically as they’ve searched, even if they reached me indirectly through the leads agency. As a result, I don’t have to lie when I tell them that they asked for the information I am trying bring them. I pay that much just to be ethical. I could have bought 124 unethical leads for the same price and used the script my trainers gave me. To do that, I would have to push sell, rather than pull sell, not just lie. Sure they asked for that info at some point, some of them have anyway. But either way they didn’t ask me for it. They didn’t even ask a company I work for for it.

I used to own the domain name “pullerama.com” because I hated spam and pushy ads that intruded on my life and workspace. I started building a search engine in 1998 but I was unable to compete with the speed, efficiency and capacity of Google and didn’t get that business funded. It was designed to solve the problem Google has created by reselling personal data.

The type two salesman doesn’t care about any of that. Many of them will lie to make a sale. Others will find ways to rewrite their pitch so that what they say is all true. But they have this in common. They see success in numbers. And success is all they care about. They are told to call each lead nine times daily. Yes, that’s right. Nine times. Three times in the morning, three in the afternoon and three in the evening. There is rarely an answer on the first call, but by calling three times, the solicitation survivor may just figure it’s urgent and not be another salesman.

Never leave a voicemail until the third call, I was told. That’s how all the successful agents do it. Push! And never give up on that process, we are told. Do it for thirty work days in a row. Buy new leads every Sunday and Wednesday night. Work them from 8am to 9pm daily. Get licensed on the opposite coast from what you live on so you can have more calling hours. Date your leads. Slow down calls on the “older” leads to once every week after they’re a month old. And then after three months, you dial them once per month. That’s what I was advised to do.

Successful insurance agents on their teams follow this process religiously. Then one day they figure out how to use auto dialers and hire cheap labor from foreign countries to transfer their calls to them. A few of them hire marketing agencies to build them landing pages and ad campaigns to skirt this cycle, but most do it low tech. They just keep buying those old cheap leads. And when they hire somebody to make their calls for them, they leverage their time. Ahhh. Peace at last. No more people cussing at them and dodging them all day long.

It’s a better use of their personal time, but a type one personality will still see this as woefully unethical. It reminds me of the meat industry. Consumers don’t sense the killing because that part all takes place at the butcher shop. They pay for it and the problem remains. They just don’t have to personally experience it.

It takes most of the push away from their lives too. It even becomes enjoyable. Once they have you on the phone, they reel you in like a fish on the line. Pulling you in feels like pull. You improve your sales skills. Closing the deal feels like something they asked you for because it isn’t the hundredth dial you’ve made that day and all you need to do is get better at anticipating your objections. First they hook you on the line with a good listening strategy that involves repeating what you just got them to say, or verify from the data you purchased.

A good type two personality will master this and be convinced – “Whatever you just admitted to me you needed, you just asked for and you agreed I could solve your problem. You sold me. I didn’t sell you.”

An ideal type two personality may even be honest about all this and admit, “this may not be the best solution, but you didn’t call me because I had the best solution. You called me because you said you needed this.”

And they are closers. You just told me you needed this, right? You showed me you could afford it. Right? So what is stopping you from doing this right now? Why do you need to talk to your brother about it? What if you die today? Didn’t you just say you needed it? Why are you thinking about it? What are you not telling me? What are you afraid of? Let’s get this done right away. What is your social security number and bank-routing number?”

That last part was a joke. Insurance agents do need to access this personal information. We have to earn trust somewhere in this conversation. Trust is one disadvantage a person making hundreds of outbound calls daily has. But a true type two agent will recognize that this is just part of the numbers game they play. Some will balk at giving out personal info to someone who has just called them. They learn to ask these questions last as they complete their telephone applications. If something about that call seems like a scam, they’ll lose the sale. None of this matters. The sales agent who has the successful personality type – type two- will know what the SMSMSW acronym stands for. “Some will some won’t. So what?”

A good type two agent needs to have some narcisistic personality traits. They need to be empathetic enough to sense what a person is thinking, but not have so much empathy they can’t use and hurt them for their own advantage. They’ll learn to skirt the fact that insurance payments have to be made monthly for the better part of a prospective client’s entire life – that this is one of the more important decisions they will ever make. And if they know for a fact that they aren’t offering them the ideal product for their needs, no matter how well they convince themselves they really care about them, they’ll choose their personal comission over what is in the clients best interest. Have you won their trust? Are they feeling somehow uneasy? Call them on it. “Why specifically are you feeling hesitant? You won’t know if you qualify if you don’t apply. You can get a refund over the next thirty days if you change your mind and find something better.” Leave the responsibility of further research with the client. If they pay more for less or have buyer’s remorse after the thirty day refundability period expires, that’s their problem.

And that, my friends, is why five year-old leads are still being bought and sold. If I was a lawmaker, I would be doing something about that. Medicare is highly regulated to prevent this very type of thing. Non-government funded insurance products, not so much.

Bad Weeks Revisited and the IUL

Now step into my shoes. Imagine for a minute that I pay a thousand dollars a week for fifty live transfer leads at a rate of four leads a day, supposing that I can sell an average of 1:4, or one sold policy per day. An average life insurance policy commission advances me ten months of premiums typically yielding somewhere in the range of $500 to $1,500 in advanced commissions once the first premium gets paid. So I start out my week thinking I should be able to net $4,000/week in net income that I’ll receive into my bank account in another week or two. Now I can also expect that some clients will die in their first year. If that happens, I’ll have to pay back my commission advance. I’ll also lose it if they cancel any time the first year. These are called, “charge backs.” If the system worked the way it should, at that rate I would be earning over $200,000/year and probably paying back 20% in charge backs, so I should net $160,000/year. That was my business plan.

But there is a problem. Now imagine that the very same people that have called me have agreed with me, that me shopping for them so that they don’t continue to be barraged with phone calls is a good idea. But then picture them not responding to my texts or phone calls after I actually do conduct an hour or two of research for them to determine what the optimal solution is, given what they’ve told me.

Being a type-one agent, I might suppose the decision should center around whether what the carriers will offer fits into their budget. I may have done a quick scan while I was on the phone with them, but thinking that I am helping them solve the problem of shopping for insurance, I may need to compare things that an immediate scan won’t show, so that there is no possibility that my answer isn’t the ideal answer given their situation.

This happens when they are in poor health and I find out that the top carriers would offer them immediate coverage of the full face amount on a policy so I have to check outside that database and it also happens with people who are in very good health and qualify for an IUL.

Let’s talk about IULs. One of the most desirable insurance products is something called an Indexed Universal Life policy (IUL). I have contracts with quite a number of IUL providers, and these are considered the gold standard in insurance. But there are a lot of moving parts in IULs and not every carrier is offering the same product, making comparison shopping not all that simple. The better ones are like whole life policies in that they offer a face value benefit that is immediately payable in the event of death or certain conditions like terminal or chronic illnesses, but they also offer a cash value for life that is likely to grow more rapidly over time than a traditional whole life policy.

My point here is that researching the best policies is not something that can be accomplished during a single inbound phone call unless someone’s health falls somewhere in the middle. To do the right thing, I’ll have to do some research and call them back when I’ve come up with an optimal solution.

And therein lies the cog in the wheel of my business plan. As soon as I position myself to have to call them back, my very real, probably very best possible solution among all competitors, never reaches them. They have blocked my texts and calls and voice messages. They have failed to put my name in their contacts as they said they would, and I’ve wasted somewhere between two to three hours of my time and anywhere between $48 to $61. In truth, even though my lead was exclusive, they have already looked at Google to see what else they could find, and their contact info has been sold a hundred times. In the two or three hours it takes to gather up the information and take another inbound call or two, they’ve already received five more phone calls and they’ve forgotten who I was. As a result, I’m shooting myself in the foot by promising them I’ll check to make sure this is the very best product, or to go see if there is another carrier that might offer them immediate insurance, when an initial scan only indicated they could qualify for a guaranteed issue policy that won’t pay out full benefits until the third or fourth year.

I’ve had more than a few bad weeks because of this and it adds up. I can’t compete with AI and highly funded, organization-slick champion type two agents, who keep stealing my ethical old fashioned business. It’s even become unsustainable. Life before health made sense when all I was doing was in-home appointments here in Tallahassee locally. But I outgrew my local market. Tallahassee is a small city.

Pivoting

My wife hates the word “pivot.” She’s heard it way too many times and it always means that some business concept of mine is failing and needs to be adjusted. “Pivoting” sounds sort of like a radical change of direction, in fact, not just a minor tweak. And to be honest, one thing I know I can’t do, is pivot to an unethical proven success model. I can’t pivot my personality type.

What I can do, is I can ask for referrals. What I can do, is I can go out into pharmacies with a table and let people come to me out there. I can focus my energy on my ACA, Medicare, DSNP and private plan business. What I can do, is ask that if my friends see anyone who is on Medicaid, or needs to be, or qualifies for disability but got refused, that they be the ones to help them connect with Health and Human Services to get them the Medicaid they need, or with a social security disability attorney who will take them through another round of applications, and to help them log into SSA.gov and make sure they’ve applied for Medicare. They need to write down their Medicare Part A and Part B numbers once they’ve applied and if they have a Medicare card, I’m going to need to see it so I know what plan they’re currently on.

I’m thinking of people who have had life-altering accidents and strokes or who have otherwise become impaired and unable to help themselves or help me help them. Not everyone has family members who know how to help. If you will do that, then I can add efficiency to my business model by spending my time researching their best health plan options. I am really good at both life and health. But life has been beating me up. I’ve had one too many bad weeks. I’ll still do it, but I can’t both be ethical and win the rat race without your help. Help me help others. Quality referrals are my only hope. Can you help me with this?