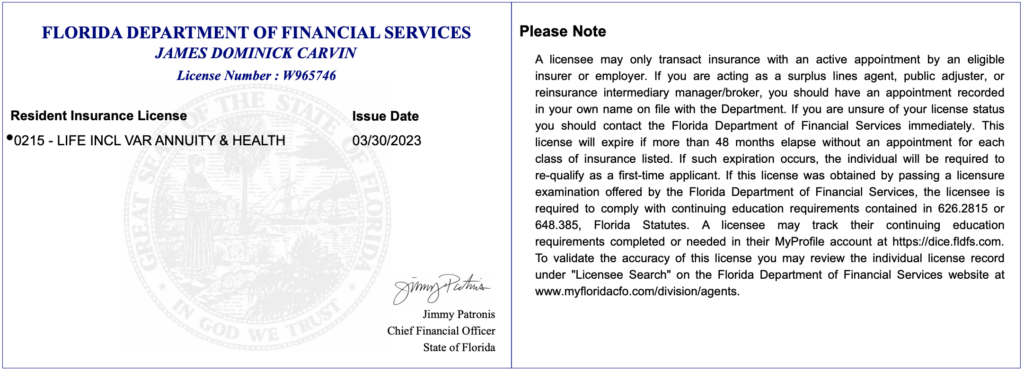

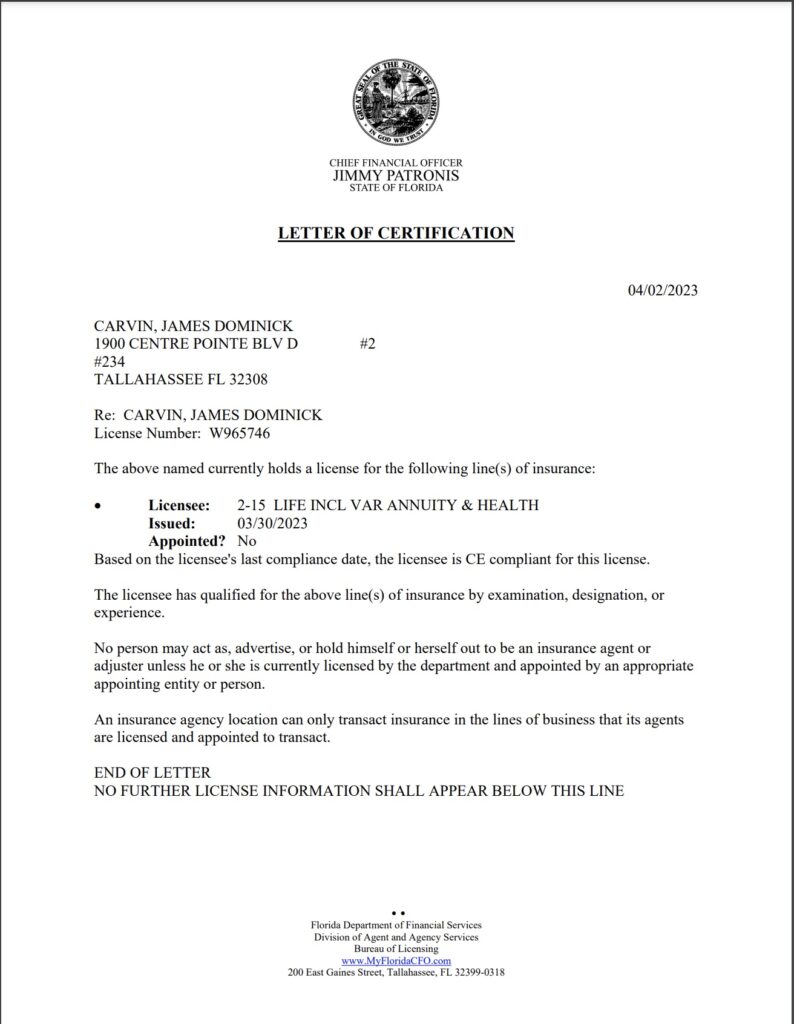

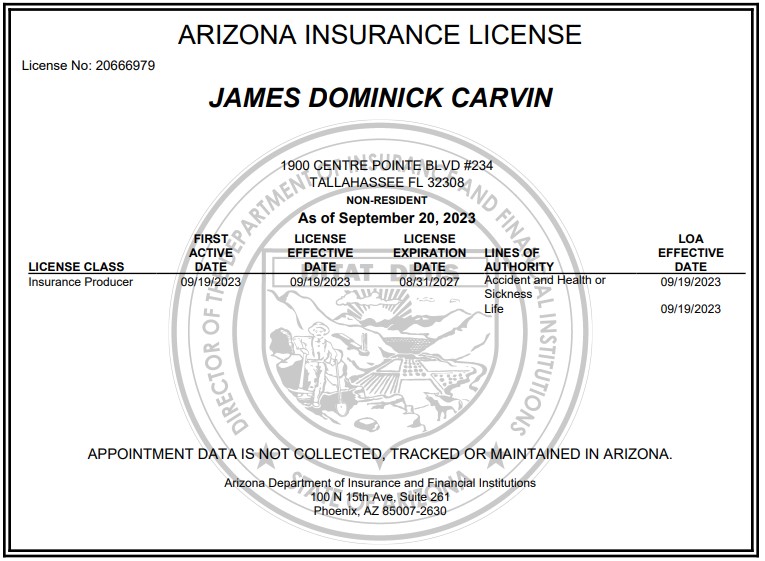

I am an independent life, accident and health insurance producing agent based in Florida, licensed in multiple states:

- Arizona (20666979)

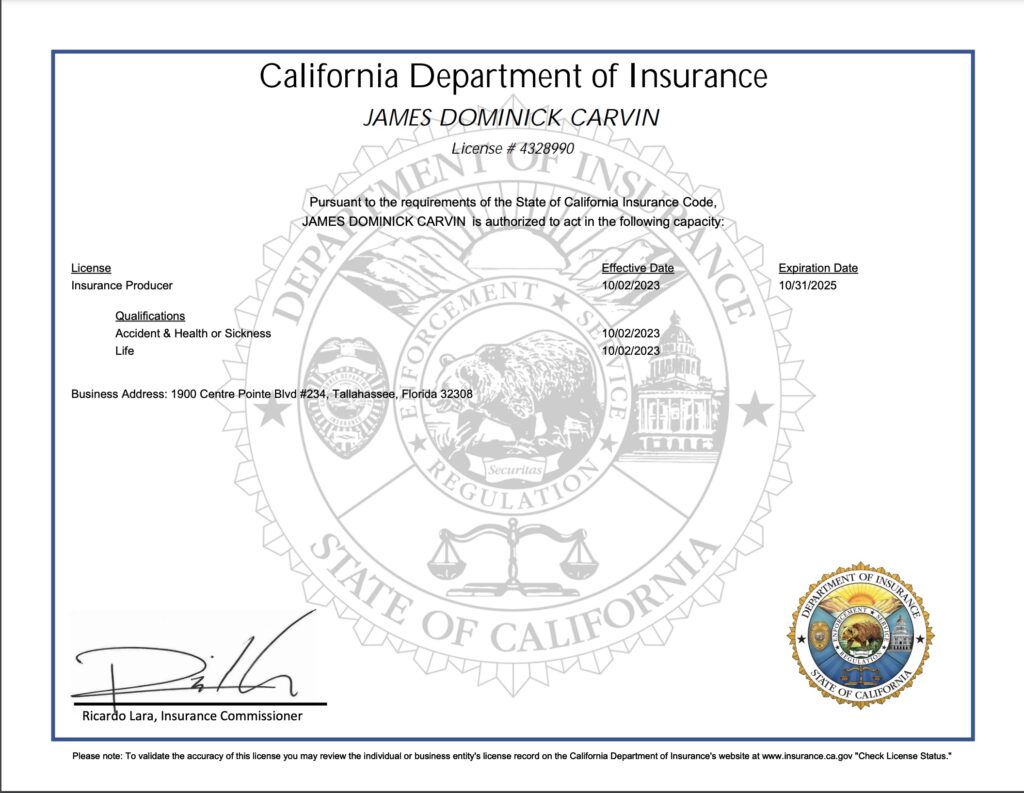

- California (4328990)

- Florida (W965746)

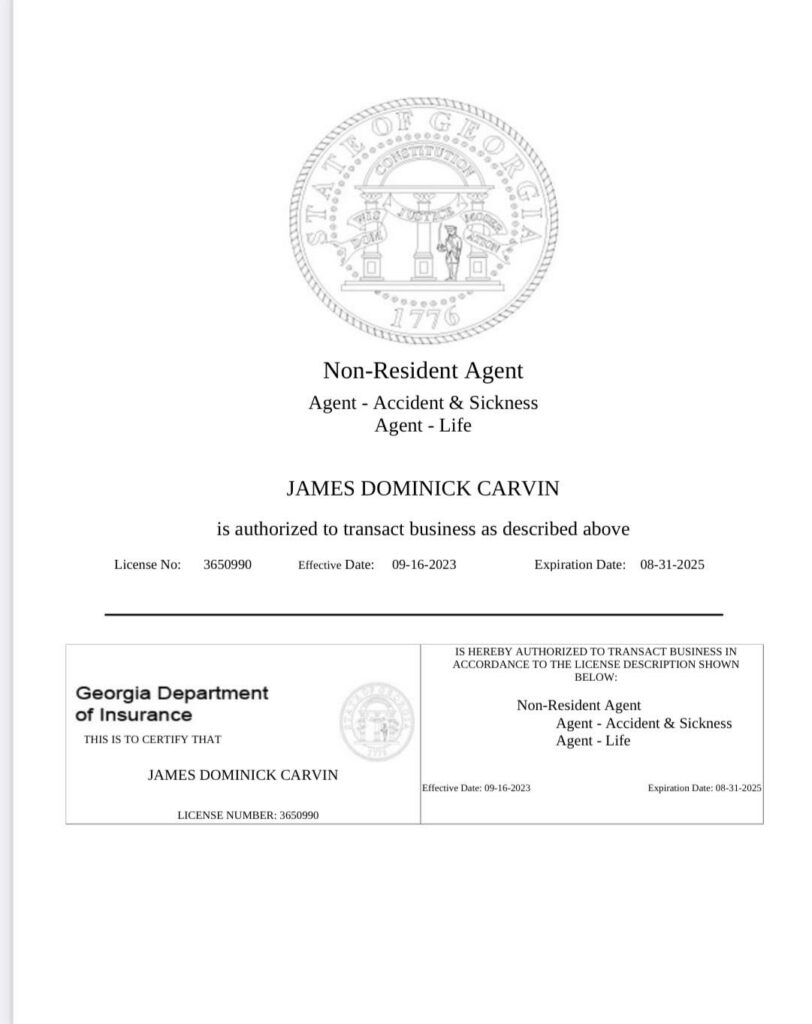

- Georgia (3650990)

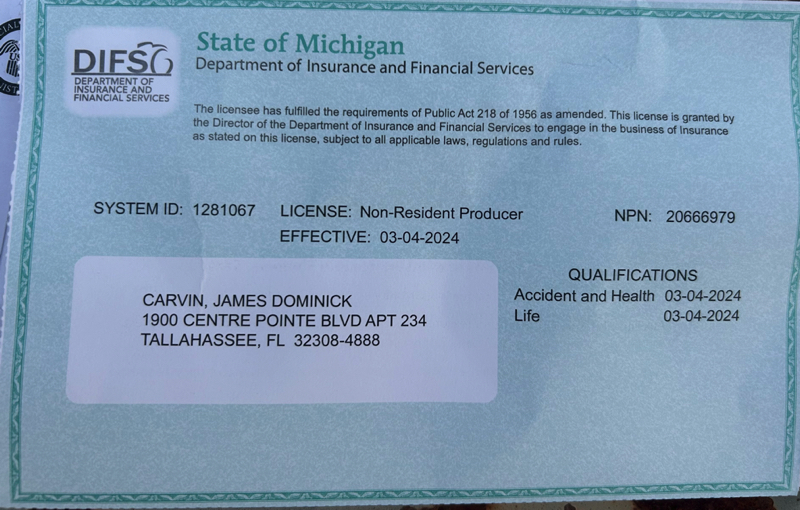

- Michigan (20666979)

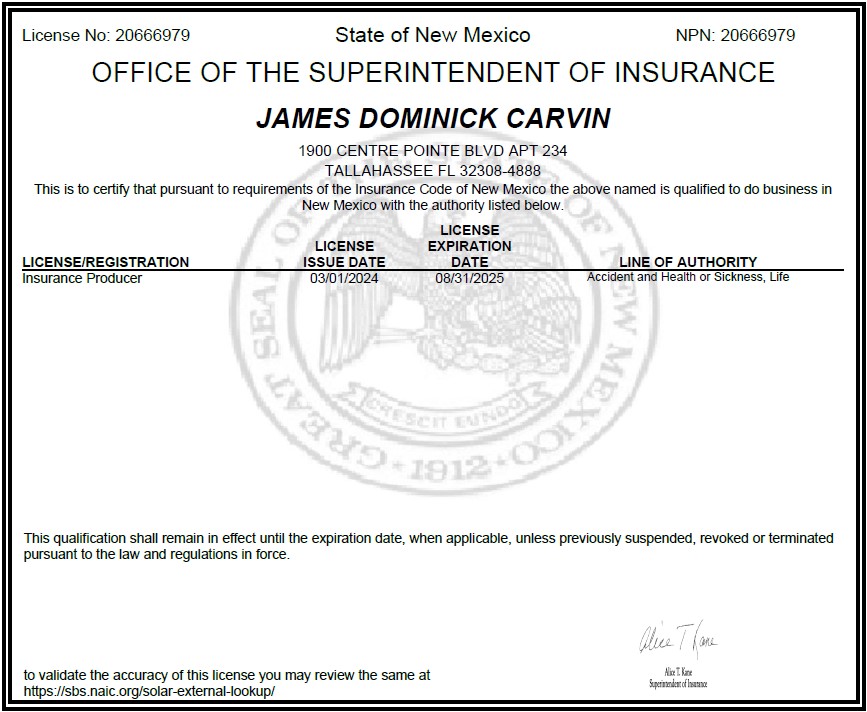

- New Mexico (20666979)

- South Dakota (40718581)

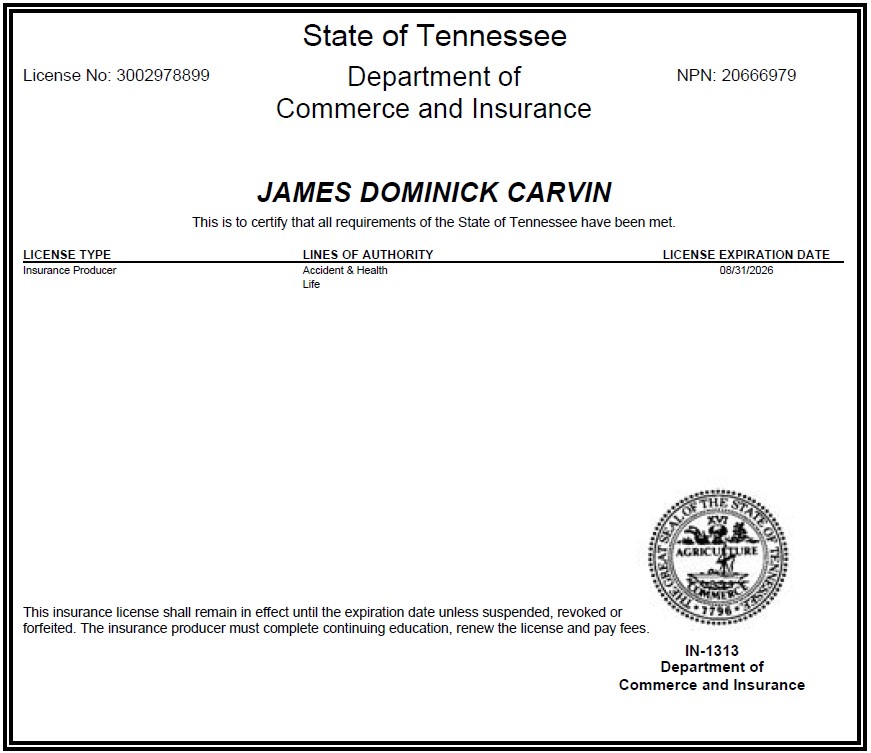

- Tennessee (3002978899)

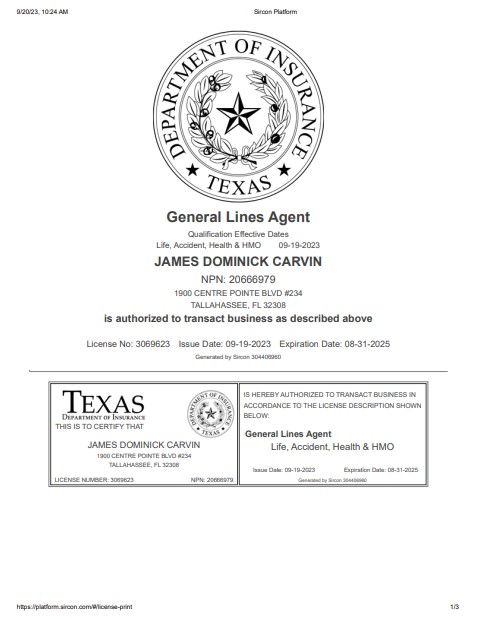

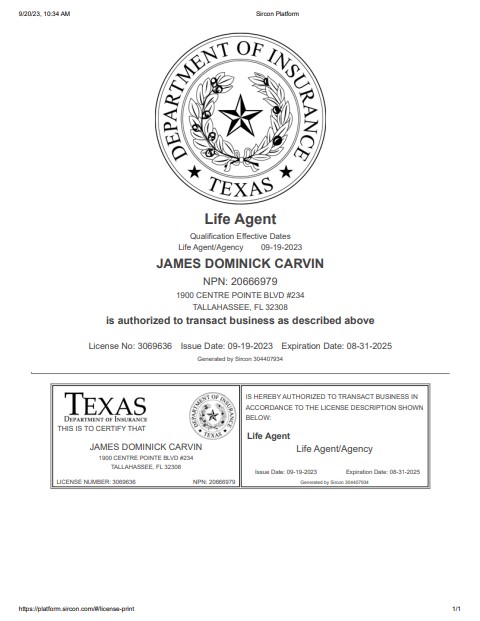

- Texas (3069623/3069636)

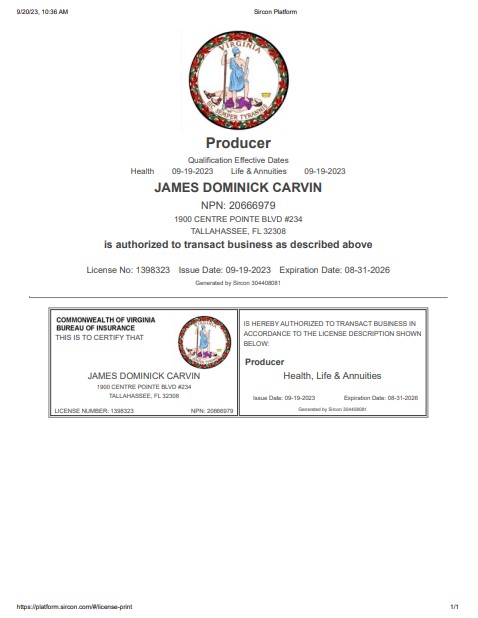

- Virginia (1398323)

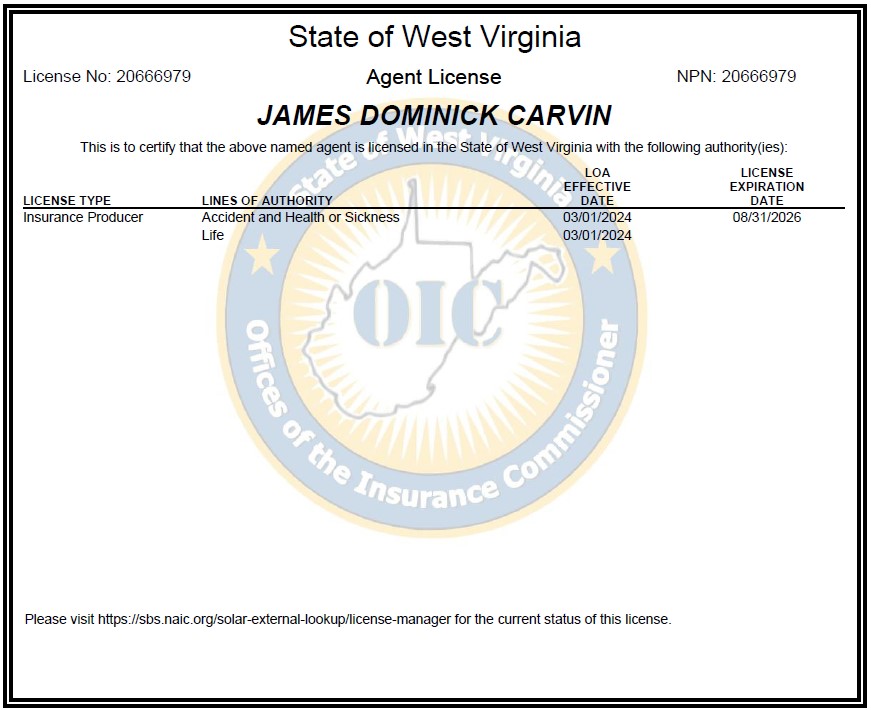

- West Virginia (20666979).

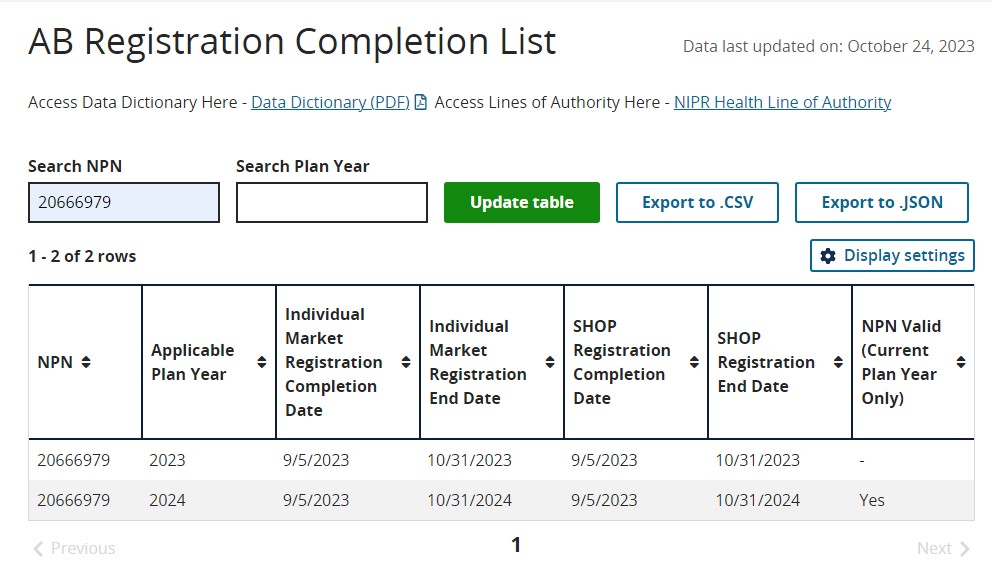

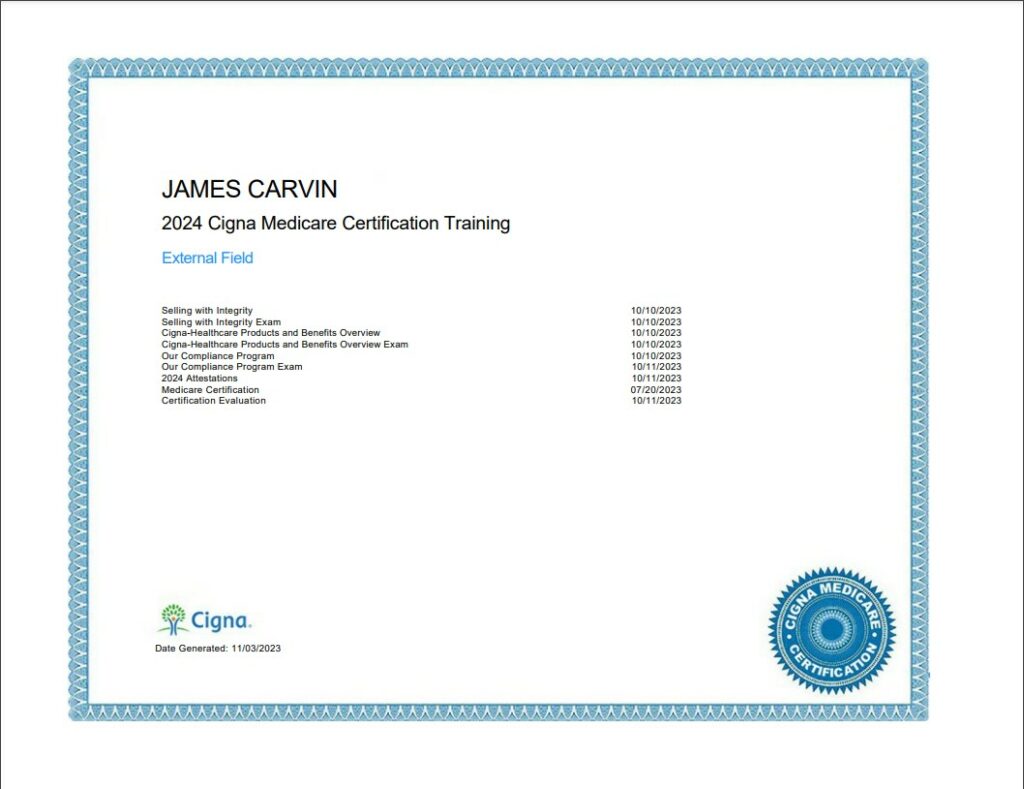

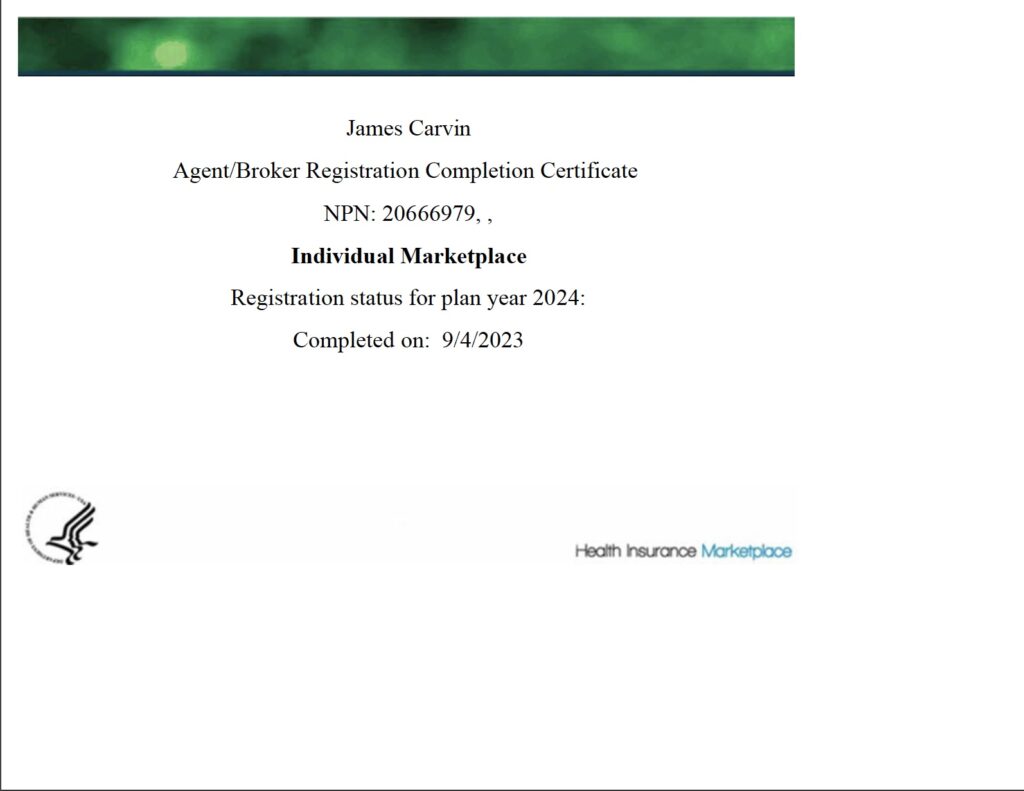

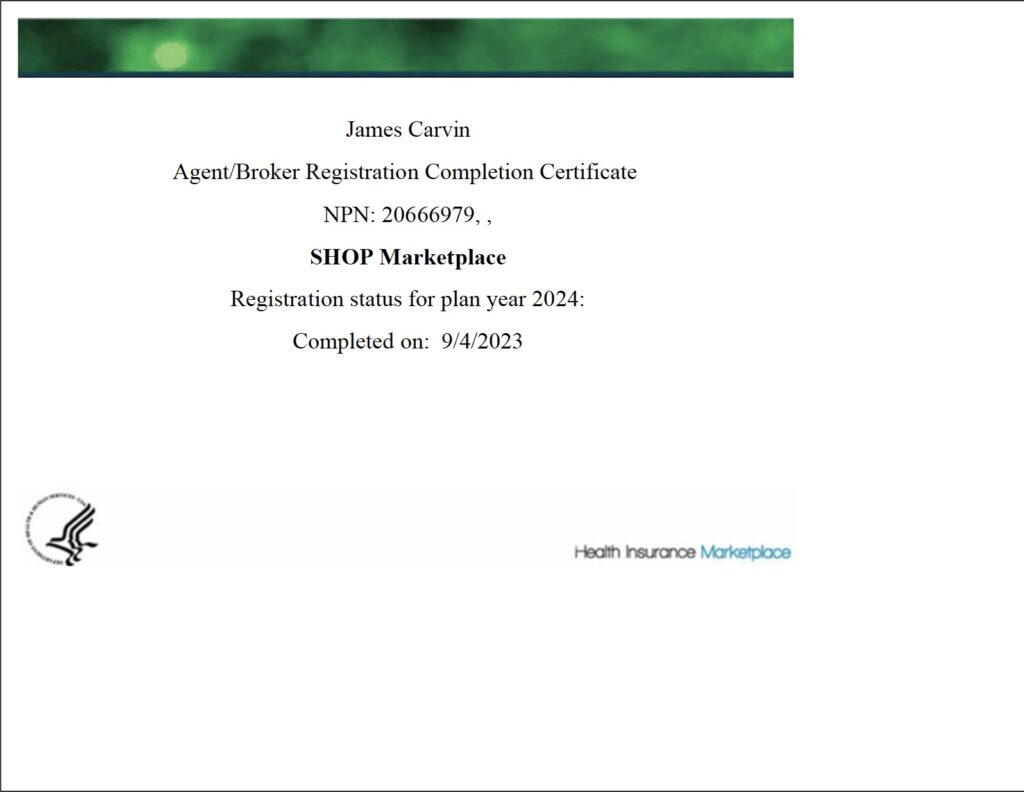

My license information and up-to-date certifications for continuing education requirements are included below for those who may need to check my credentials and eligibility.

NON-RESIDENT LICENCES

As my business expands, I will continue to add state life and health insurance licenses to this page. All licenses and certifications listed here are current.

Medicare Certifications

Marketplace Certifications (ACA/FFM)

About Me

I got into the life insurance business in my sixties after graduating from Arizona State University with a 4.0 average. My degree was in Interdisciplinary Studies with concentrations in Organizational Leadership and Philosophy. I already had a degree in Music Composition from the University of South Carolina that I’d earned in 1980 while on a springboard diving scholarship. And then after that I earned a theology degree, as well, after six years of study in two small colleges in South Florida – St. Vincent de Paul Seminary and St. Michael Academy, where I also served as an adjunct professor. I am a highly dedicated, very detail oriented person, who loves to teach and lead. JamesCarvin.com is a comprehensive web site that tells you not just about my life and health insurance brokerage but about my philosophical and entrepreneurial endeavors. Last year I completed Season One of my Awesomeology solo podcast. I’m currently looking for a co-host for Season Two. My motto is “Maximized Awesomeness.”

I am an Independent Broker working with Multiple Carriers and Plans.

I am not captive to one company or plan. I work with you as an independent broker to assess your family’s needs and goals. Many people ask for quotes when what they really need is guidance. Being independent enables me to do this.

There are three major marketing organizations I work with. Each contracts with multiple carriers to serve as many needs as possible. I do not have contracts with every carrier that these IMOs serve:

- Family First Life – FFL contracts with a majority of A-rated life insurance companies, as assessed by AM Best, Fitch, Moody’s and Standard & Poor’s. I personally scan through ninety five A-rated carriers to find you the cheapest plan within your budget using FFL’s unique tools. FFL specializes in whole life, term, mortgage protection, children’s policies, annuities, IUL’s and accidental insurance.

- Benzy – Benzy has contracts with well known carriers to provide health matching accounts and private indemnity plans that cover hospital costs, accidents, illness and out of pocket expenses from dental, health, vision, cancer, heart attack and stroke. Their ideal clients are in generally good health and they don’t benefit much from ACA tax benefits or cost sharing from the health marketplace. If you’ve been paying high premiums, high deductibles, high copays and astronomical cost sharing on top of that, then I can help you eliminate it through an indemnity plan and a health matching account. Benzy specializes in private health plans that don’t pass the high costs of pre-existing conditions and predictable expenses like pregnancy onto other members of the network, as is the case with ACA plans and other comprehensive medical plans.

- Kellogg – Kellogg Insurance is my marketing portal for traditional comprehensive health plans and plans for seniors. Whether you qualify for accelerated tax credits and cost sharing due to your lower income, or you have pre-existing conditions or you are in your silver years, Kellogg has provided me the organizational power and training to help me help you.

In any of these areas, it is my goal to help you locate the ideal product for your personal, needs, qualifications and budget. Please note that I have contracts with many but not every carrier and my portfolio of products continues to improve over time as do the number of markets I serve.

Arrange a Consultation

- If you are married, it is advisable that your spouse be present and attentive.

- Carriers require payment and other sensitive information to set up monthly payments and check medical history for simplified underwriting.

- Bloodwork and labs are not required for the majority of policies.

If you live in the Tallahassee vacinity, I am happy to accomodate those who prefer in-home consultations up to about fifty miles in any direction. Most of my work is over the phone or on Zoom. When signing electronically, many carriers will require an active email address and/or text. If you don’t have Zoom, I can share screens using your desktop or laptop’s browser. Typically over the phone there will be a discovery call followed by a plan call. Some carriers may require recording all contact and a 48 hour advance appointment using a scope of appointment form. To arrange a consultation of any type, click here.