A Health Matching Account (HMA) is not to be confused with a Health Savings Account (HSA). An HSA will have value only while insured if a person qualifies and utilizes its benefits during that time. An HMA retains its value after you quit a job and when you change insurance plans. Its value lasts. Even going on Medicare doesn’t disqualify eligibility.

Neither does poor health. It is a genuine savings plan.

It’s my mission to save clients money while optimizing the perfect combination of insurance programs they qualify for – so they can keep it. There is nothing that can crack a nest egg faster than unplanned for health issues and accidents. Cancer, heart attack, stroke, highway accidents and fatalities – these things rock families to the core. And what about if we live long but don’t prosper? Long term care plans may be required. But do they even exist? What is your plan?

Life is a gamble. Insurance turns it into a sure bet. But is it adequate?

The problem is that the house always wins. The odds are always slightly stacked in favor of the Insurance Company rather than the consumer. That is their business model. That is how they stay in profit. They collect more in premiums than they pay out.

Insurance companies are in the business of gambling according to the odds. The odds are you won’t need your insurance right away. So what is its value to you, the consumer?

What insurance pays for is peace of mind, knowing that if we get unlucky, we’re still covered. As an independent insurance agent, that is what I sell – peace of mind. Thanks to insurance, the bad case and worst case scenarios in life become less bad and less worse. There’s peace in that. And the peace I sell costs less and buys more because I do the shopping for my clients so they can also know they aren’t paying more for less.

I sell both life insurance and every form of health insurance. But on the health insurance side, there is a problem. The cost of health care keeps going up and so do the premiums. People can’t afford adequate policies any more.

I hate that only the wealthy can afford peace. My sister suffered such a long and painful death – on a feeding tube, in dementia, not understanding why she was paralyzed, why Jesus wasn’t answering her prayers, unable to communicate that she might want a DNR.

It was horrible.

Her husband had abandoned her and only her four surviving brothers, who all lived in different cities, were left to make sure she was cared for. I moved with my wife to Tallahassee to stay close to her and make sure she wasn’t being left alone in her nursing home without proper attention. I never announced when I was visiting. And it was never enough.

Sometimes she would be asleep. I would visit the other residents. There were rarely any other visitors. I didn’t go into the rooms except my sister’s, though I would sure liked to have kept the staff accountable. Those in the common areas – the patio, the tv room, the dining halls -these managed to sit in wheel chairs. Some could turn the wheels by themselves. Others had to be pushed. They all had stories to tell. I fell in love a hundred times.

Do you have family that would visit you if you were forced to live in a nursing home and were in very deep need? How often would they come? How many hours would they stay? If you had the very best nursing home care, how much of an improvement would that be over the worst nursing home care where you live? Have you visited your local nursing homes to consider what the answers to this question might be? Consider this a mandatory assignment. Consider it a personal responsibility. And most importantly …

Do you realize that more people will wind up dying after long stays in nursing homes than not?

Some die by accident. My mother was very lucky. She didn’t pay for assisted living. She lived by herself for sixteen years after my father died. Then one day, unexpectedly, when she was ninety years old, she died of a heart attack. She was very lucky. We all were. We couldn’t afford a nursing home. And she was on Medicare. She didn’t have adequate nursing home coverage. She didn’t have any sort of a long term care plan at all. We all gambled with her health. And we got lucky that she won that gamble. The Lord took her very suddenly.

My sister was not so lucky. I watched her suffer daily. I prayed with her. Corinne only received as much care as Medicaid would pay for. The rest would have to come from the charity of her family. The words “adequate care” stretched the word “adequate” to new lows. I saw her daily, seemingly endless torment, and I wondered whether my own life would end with a story like hers. Maybe I would get lucky and die more suddenly, like my Mom.

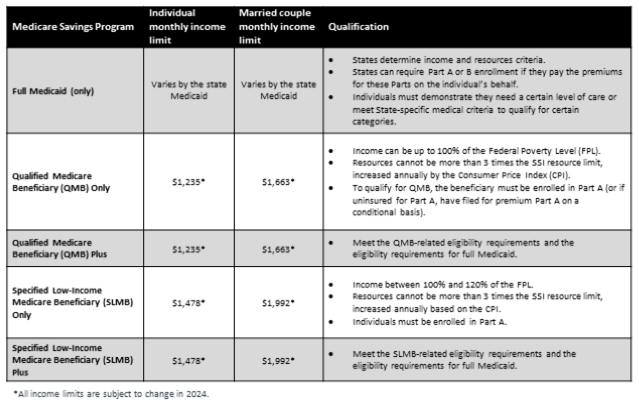

Given this deep reality in my life, I’m surprised more people don’t ask me about long term care. A friend I have, who was about to turn sixty, and who has a history of health problems, did ask me about long term care plans. He was already on disability and eligible for Medicare, perplexed that long term care was inadequately covered by the government.

Well they do. The plan is Medicaid. First the patient and their family burn through whatever savings they’ve struggled to amass all their lives. Then after that, they qualify for Medicaid. Then when they die, unless they have a life insurance policy, the family gets no inheritance and has to pay for their funeral expenses. I’ve seen this more times than I can count.

It’s tragic. My poor friend had worked so hard all his life to put his children through school and to pay for his divorce. His children had moved away. Now here he was all alone, realizing that his life was likely to be like that of my sister. He was trying to form a plan. And someone told him that at the age of sixty long term care (LTC) plans get significantly more expensive and offer fewer benefits.

The reality of a person’s retirement picture hits hard at the age of sixty. But the time to start working on it begins decades before that.

He was right about the sudden leap in premium costs at age sixty though. So he turned to me – the miracle worker. If anybody can solve an insurance problem, it’s me. Unfortunately, I had to let him know that no sound insurance company would qualify him. He was stuck with no long term care plan. I told him that when open enrollment season came up for Medicare that I would review plans with him and let him know what the best option was. We’d have to set an appointment 48 hours in advance for that.

But I gave him one other piece of advice – one that it wasn’t too late for him to do. Enroll in an HMA.

Everyone should have an HMA. To put it simply, an HMA aims at cutting out-of-pocket expenses in half. It’s important to note that it is not an insurance plan at all. It’s a savings plan. That’s why they don’t use the word “premiums.” You pay maintenance fees and make contributions to your savings plan. Your contributions are then matched by the plan, which builds up the benefits value you have available. It’s better than insurance really. With insurance you start over every year. With an HMA you accumulate value that carries over year to year.

Did you watch some videos?

So let’s say my friend goes into a nursing home long term when he turns seventy and has sixty thousand dollars accumulated in his HMA plan by then. At that point, let’s say he has a choice between two nursing homes – Abundant Staff Pamper Place or Minimal Medicaid Manor.

He may just be able to afford Abundant Staff Pamper Place if he has that HMA. He may not be able to do that if he depends on his own savings or on Medicare. An HMA may not solve all of his problems, but it might just cut them in half.

Perhaps mosty importantly, he may not ever need long term care at all. How does he know he’s going to spend years of his life in a nursiong home? He doesn’t know that. He may need to use his benefits somewhere else. What if he just needs to cover his pain medication as his arthritis gets worse until one day God is merciful to him and he dies of a heart attack? If that is the case, his main concern will be paying for his medication. If it isn’t covered under his Medicare plan, he can pay for the rest using his HMA.

The difference between an HMA and insurance is like the difference between cash and barter. An HMA is simply more efficient and useful – like cash.

The Pamalogist

Think about it. Unless my friend exceeds his HMA plan limit, his only out-of-pocket cost is his monthly HMA plan contribution. His HMA may just cover all of his annual deductibles and copays, plus the cost of any uncovered meds. That’s equivalent to 100% coverage. We don’t know what will happen in life. But an HMA covers more possibilities because it isn’t limited to a specific type of medical need.

An HMA is the only kind of plan I can think of where the consumer wins every time. Every other kind of plan is gambling against the house while the odds are stacked in the favor of the casino.

HMAs are for individuals, for families and for employers looking for better benefits for their employees. You won’t be disqualified for pre-existing conditions. There is no health check.

Watch the video I’ve posted here for more details on how HMAs work. Decide on your budget. Let your contribution to your HMA plan become part of your monthly budget. Even though it is not technically an insurance plan, you do need to pay monthly. If you don’t make your monthly contributions on time, you will lose your benefits. Nothing else can cause you to lose your benefits but it is imperative that you not commit to more than you can comfortably afford.

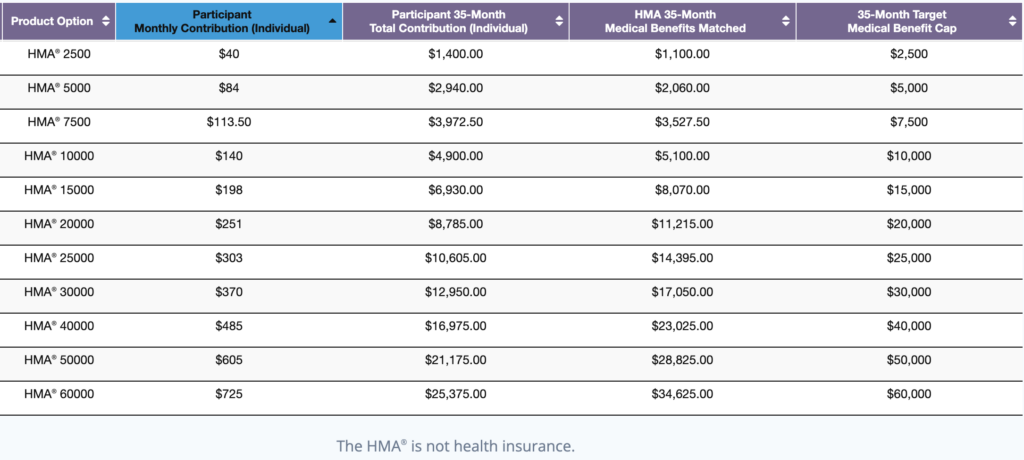

There are eleven plans – something for every budget. They start as low as $40/month to $725/month for individuals. Spouses and children can also be covered. Never spend more than you can afford. Here is the breakdown …