Insurance is ridiculously complicated. And what saddens me is that the people who need it the most, are the ones least capable of obtaining it. Even if they can afford it, it’s just really hard to know who to turn to for answers. Heck, it’s not even easy to figure out what the questions are supposed to be.

Lately, I’ve been expanding my contracting in the states I’m licensed in. And that means I’ve been doing all sorts of additional training. My goal is to offer best of class healthcare coverage in every county. Life insurance is easy by comparison. It’s by state. If I’m licensed in your state, counties don’t matter. You’ll be covered. Health Insurance – that’s a different beast. First, there is the type you need. Then there is where you need it. What county do you live in? And then there is the type of network you want. Will you lose your doctor, or a much needed specialist if you change plans? Will your drugs all be covered? And what about if you have a chronic illness? What if you’re terminal? What if you’re in a nursing home? What if you are very poor and can’t afford standard healthcare?

With all these questions, you would be right if you guessed that it’s a little more complicated to provide a health plan than a life insurance policy. And to be honest, it doesn’t pay me as much. Many of my peers in the insurance business avoid it because it is a lot of work.

But I can’t do that. My inescapable reality is that I have a bleeding heart and it’s the people that need my help the most, that cry out for attention. I want to help them. The rich have more than enough helpers. The seriously infirm, the marginally qualified, those with special needs, those who might qualify for Medicaid and Special Needs Programs, those who need translators – these all need better support than they now have. And most don’t know how to ask for it. On a daily basis, I find that I’m like a sponge soaking up all I can to prepare myself to help. And be ready next time someone calls for it.

It can be distressing. Look at the lingo. According to the Centers for Medicare and Medicaid Services (CMS), those who qualify for dual special needs programs, (where they could get Medicaid and the state to pay for all or part of their Medicare expenses), are classified into the following five possible types. When I help them apply, I’ve got to classify them correctly. Tell me if this all sounds clear as mud to you.

FBDE – Full Benefit Dual Eligible only

- Full Medicaid coverage refers to the package of services, beyond coverage for Medicare premiums and cost-sharing, that certain individuals are entitle to when they qualify under eligibility categories covered under a state’s Medicaid program. Some of these coverage groups are ones that states must cover (for example, Supplemental Security Income [SSI] beneficiares), and some are groups that states have the option to cover (for example, the “special income level” institutionalized group for individuals or home-and community-based waiver participants and “medically needy” individuals).

- These indivudals get Medicaid only, are enrolled in Medicare Part A and/or B, and qualify for full Medicaid benefits, but not for Medicare Savings Program c ategories. However, the state may pay for their Part B premiums.

- Beneficiaries pay no more than the amount allowed under the state’s Medicaid program for services furnished by Medicare providers.

QMB – Qualified Medicare Beneficiary Only without Other Medicaid

- Medicaid pays Part A (if any) and Part B premiums.

- Medicaid pays Medicare deductibles, coinsurance, and copayments for services furnished by Medicare providers for Medicare-covered items and services (even if the Medicaid State Plan payment does not fully pay these charges, the QMB is not liable for them).

QMB+ – Qualified Medicare Beneficiary Plus

- Medicaid pays Part A (if any) and Part B premiums.

- Medicaid pays Medicare deductibles, coinsurance and copayments for services furnished by Medicare providers for Medicare-covered items and services (even if the Medicaid State Plan payment does not fully pay these charges, the QMB is not liable for them).

- Get “full Medicaid” coverage in addition to coverage for Medicare premiums and cost-sharing.

SLMB – Specified Low Income Medicare Beneficiary Only

- Medicaid pays Part B premiums.

SLMB+ – Specified Low-Income Medicare Beneficiary Plus program

- Medicaid pays Part B premiums.

- Get full Medicaid coverage in addition to coverage for Medicare Part B premiums.

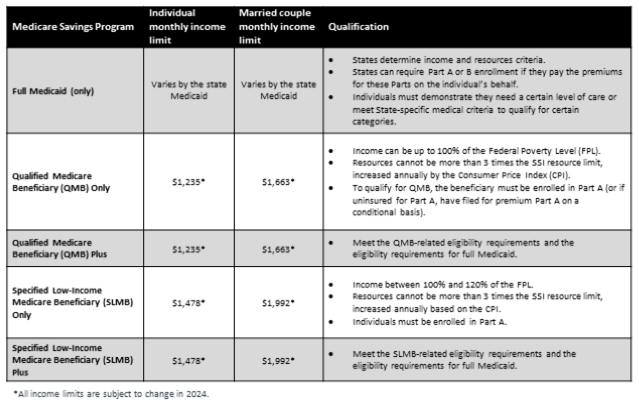

2023 & 2024 Qualified Benefit Levels & Qualifications

So what does all this mean?!

What this means and what to do about it are two different questions. What it means is some people qualify for extra help as spelled out above. Any US citizen falling on or below the poverty line is likely to qualify for state Medicaid. Even if they are as much 20% above the Federal Poverty Level (FPL), they can at least qualify to get their Medicare Part B premium covered. When people are on a low fixed income, every dollar counts.

What you can do about it is help me help people. Get them onto Medicaid, if you can. If not, see what they qualify for by helping them pay their bills. See if you can help them prove their income at their local Medicaid office.

If you’ll do that, I’ll do this

It takes a village. Having a bleeding heart is sweet, but I’m about maximizing the good I do. I know that if I spend my time tirelessly helping people get onto Medicaid and helping them with their bills, that I won’t be able to help those who have already taken those steps and now just need to get plugged into the best dual special needs plan for their needs so they can get to their doctor. Let me focus on the insurance side of the problem. Let their church friends and family help them with their Medicaid applications. Then let me know immediately what they’ve qualified for once they are approved. What is their individual or family income? Have they been approved for FBDE, QMB, QMB+, SLMB, or SLMB+? If you’re not sure which is which, call me. I can decipher bureaucracy-speak.

NOT AFFILIATED WITH OR ENDORSED BY THE GOVERNMENT OR FEDERAL MEDICARE PROGRAM.

Participating sales agencies represent Medicare Advantage [HMO, PPO, PFFS, and PDP] organizations that are contracted with Medicare. Enrollment depends on the plan’s contract renewal.

I do not offer every plan available in your area. Currently I represent 6 organizations in Tallahassee which offer 42 plans and other organizations with numerous but not all plans in six total states, including Florida, Georgia, Texas, Arizona, California and Virginia.