I’ve provided enough background in this MyStory series for now. Today, page 8, we jump ahead to the present. I used the word “asynalagonomy” on page 7 without explaining what it means. I told you about my Dad and I learned some things from him but incentivized asynalagonomy was not one of those things. What on earth was I thinking in 1982? My agreement with Dad was only partial and the valid points he made all resided dialectically within an anteasynalagonomic reality my father had no awareness of.

BUT WE NEED DEFINITIONS

I’m glad that there are only a handful of people who can pronounce “asynalagonomy” correctly. It takes a little practice. An even harder word is “anteasynalagonomy.” The fact that these words are hard to pronounce means they won’t be shared much and that gives me the opportunity to control what people think of them. This is strategic for me. I recognize that we live in a day when the meaning of many words shifts from month to month because of the tools of mass communication. Look up the word on Google and it turns the reader to this web site. That took some doing. Let it be.

I’ve defined it elsewhere here and I’m happy to help out on the meaning and pronunciation any time. “Ante” means “before.” “Synalagonomy” means a trade-based economy. The prefix “a” means “not.” So the word asynalagonomy means “an economy that is not based on trade” and anteasynalagonomy all put together means “the time before a tradeless economy,” or more specifically, “the economy of the time before a tradeless economy.” It means now.

So that’s the meaning. Now let’s practice the pronunciation.

- “Ante” sounds like what you do before you play a hand of poker. You ante up.

- “a” as in “asynalagonomy” uses the hard “a” sound as in “grape” or “ate.” The hard “a” sound is practical. Soft “a” as in apple is technically acceptable but much harder to garble out, so not recommended.

- “synalagwn” is the root of this word. It comes from the Greek word for trade. Greek is an inflective language, so it is normal to change out the end of root words with all sorts of variables. That being the case, we don’t need to retain the hard “o” sound (as in “own”) just because the root is from the hard Greek omega rather than the soft Greek omicron. We can pronounce it like “on” as in “economy.”

- “gonomy” rhymes with “economy.” I won’t go into the Greek here. You can ask an etymologist about the word economy. “Nomy” means laws or rules.

Now repeat this a few times until you’re comfortable with it …

ante a synalagonomy.

ante a synalagonomy.

ante a synalagonomy.

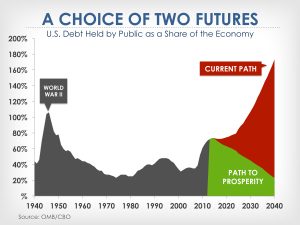

So prior to the total collapse of the sociocapitalist world, which I see as forthcoming if no one heeds my warnings and the Restoration Party is not supported, we have anteasynalagonomy. And after the total collapse of the sociocapitalist world, either we will have asynalagonomy, (hopefully an incentivized form of it), or we will have total anarchy. This last statement comprises the essence of my book, The Restoration Party Manifesto: Pre and Post Apocalyptic Solutions for the Future.

Having some limited control over how these words are used, thanks to my extreme lack of present popularity, allows me all the time I need to build an entire vision around them with all sorts of necessary distinctions. This I find essential in preparing for the collapse of modern civilization lest bad versions of the same solution pop up, as they so often do, and destroy the benefit of the thirty six years I’ve spent contemplating that future time. Most crucial, it is essential that an effective asynalagonomy be incentivized.

But that is a future world and a significant portion of those few who have been told about it, doubt it will ever happen. Even if they can envision such a collapse, they see different types of reboots – very dark ones, where the rich continue to live off the sweat of an even less empowered poor and where a US military steps in to assist them. So fine. That’s why we need Solution B Units as described in the book. As I see it, we are living in an anteasynalagonomic world, and anyone else is free to ignore the fact or disbelieve it. Well that sucks. As for me, I believe in putting life jackets and lifeboats on economies that look like they’re on the same course as the Titanic.

I have to have double vision. One is what I see. Another is what others see. One is our future reality. Another is our present reality. People are taught to see as they do from a very young age. I can’t just give them my vision. I’ve climbed a mountain and what I’ve seen from there is very different than what people who’ve always stayed in the valley imagine. I have to lead them through some very hard places to get them to see what I’ve seen. It’s a step by step process.

When we were children we played board games. Each game had its own rules. There was Monopoly, Life, Risk, Stratego, BattleShip, Chess and Checkers. They were all based on things we can readily understand – war, competition and capitalism. Other games, Trivial Pursuit, Detective and Operation introduced other facets of our world while card games taught us how to calculate. We are wired from childhood for a world that is competitive, that has sad realities. Some people lose. I can’t keep up with the modern gaming world. I imagine its the same. There are roll playing games and there are action games. I’m probably a fool for letting my son play Grand Theft Auto but there have been plenty of opportunities for me to point out that killing people and stealing their cars is wrong. Organized crime is bad. I’d rather he learn that in the cyber world. He also loves his Batman games. He obviously gets the point.

The content and basis of all those games is entirely the stuff of an anteasynalagonomy, where health care costs are rising out of control, where our enemies are increasing, where our annual budget deficits are impossible to balance, where a majority of the population has a negative net worth, where crime is a constant, where I find myself sorting out the best tax and health care policies for a new political party, seeing that the five dominant parties all fail.

I carry two separate visions. One for the future. One for now. It’s not too late to avert an economic apocalypse. But we need to mobilize the Restoration Party very quickly if we are to do so. So for the future vision, read all about incentivized asynalagonomy. It’s where things go if the world keeps ignoring my warnings, treating me like a ghost. To heed the warnings, consider moving your membership over to a new political party, the Restoration Party. Today we talk about tax reform and in my next blog we’ll cover health care reform. I find it far less promising given the difficulty of getting the Restoration Party revved up before it is too late but for now we are in full anteasynalagonomy mode. And here I will remind my readers once again that Restoration Party membership absolutely does not require any knowledge of or belief in incentivized asynalagonomy. In every situation, the Restoration Party is all about the here and now because the people the government is being restored to know and dwell in the here and now. Generally, their minds do not dwell in the future, like mine does, but they do have a profound sense of what is right. So on with the here and now.

FUNDING GOVERNMENT SOCIOCAPITALISTICALLY

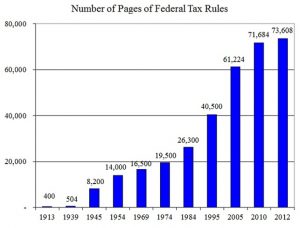

Now we get to talk about the tax policy the Restoration Party will fight for over the next few years. It doesn’t make for the most interesting blog unless you are an economist but I’ll give it a summary whirl in layman’s terms. This will require some background. There are several popular proposals out there for tax reform. All of them have simplicity in mind. Everyone agrees the tax code is too complicated. Everyone also agrees that tax loopholes are unfair.

Let’s look at the reasons the tax code is complicated and unfair. First, it is historical. Changing it requires taking what you already have and making additions, by writing new code, or deleting them, by repealing law. It’s not so hard. In theory, it could be done with one comprehensive bill, but the tax code is so long that it is impractical to have one bill that simplifies everything. Congress won’t have time to review it in any given session.

Second, there is a long standing habit of using taxation to incentivize behavior. We incentivize home ownership by allowing tax deductions on interest expense. We incentive charitable giving by allowing deductions for giving to charity. We incentivize farming by offering credits for purchasing farm equipment. The list goes on endlessly. I’d be the last person to complain about providing incentive. But the result is that there is a very long list of such incentives – so long, in fact, that there are many incentives that are more than incentives. They are loopholes. Loopholes provide ways for people and companies to avoid paying tax at all even though they are earning plenty of profit.

Third, there is systemic corruption. Lawmakers, knowing that tax code is complex and nobody with a loud voice is watching, have the liberty to squeeze both pork and gristle into bills that pass because its better to have a little smudge in a bill that gets passed and has lots of otherwise good stuff, than to have no good stuff at all. That shit needs to be removed but few people have the patience or interest. They love complaining about Wall Street getting wealthy while the working class are exploited but they don’t have the energy to do what is required to change anything. Tax code is boring. They’d rather party in the streets.

Fourth, there are pay offs. The reason pork goes into bills is political favor. Political favor doesn’t just come from constituents. It comes from lobbyists and corporations who fund political campaigns through Super PACs. This is really all the same as point three but it deserves a mention because systemic corruption is the way evil politics works and that is something the Restoration Party will confront head on continually. It is not a matter of representatives actually helping out their voter bases. Their focus is on the jobs they can get personally after their term is up, on the deals they can make under the table, and on raising funds and political support for their next campaign. It’s all about them.

Failure to actually do anything about this has resulted in a very long tax code full of loopholes that ignores the cries of voters. It will keep getting more and more complicated and increasingly unfair, and even longer despite constant complaints about these very facts. The result is the clear need for a restoration of our government back to the American people, so that it represents the voters, and not just the few who know how to manipulate the system. Specifically, those few are the very wealthy, who can afford to pay smart tax accountants and attorneys. The result is we need some force to come and correct the problem that has thus far not existed. That force is the Restoration Party.

But what about the Libertarian Party? What about the flat tax? What about the fair tax? What about the neutral tax?

Don’t be confused by ploys. The neutral tax is … neutral … and reduces or eliminates the IRS while putting the burden of collection on the states. I have no ought about that. I rather like the idea but the flat tax and fair tax, while they may propose simplicity, both fail miserably. They are creations of libertarians. Libertarians are not knights in shining armor. They are just another set of bad guys. Heed my warning on this. Restorationists agree with them on smaller government but not on free market economics and morality.

The Restoration Party demands fiscal responsibility and won’t ignore the burden of the national debt but its objective is not to bolster the wealthy, as it secretly is for Libertarians. Our goal in seeking smaller government is to protect the American people from the oppression of taxation and the impotency of government when government lacks proper funding. A flat tax doesn’t generate enough revenue at 10% or at 20% to eliminate any debt. It doesn’t even balance a budget. Gary Johnson is popular right now and he wants to employ the Fair Tax. It amazes me that the American people are falling for this just because they are so unhappy with their current choice of the lesser of two evils.

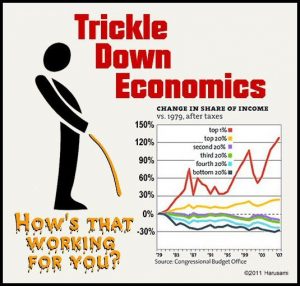

WHY THE FAIR TAX IS UNFAIR

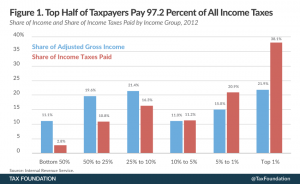

The “fair” tax starts with a national sales tax of about 30% that sells itself as 23% using some inclusive pricing trickery that I won’t get into but the number doesn’t matter, as I will explain below. The larger problem is something that it recognizes and readily admits. It has a problem of taxing the poor unfairly and it knows this. Quite simply, the poor spend all their money and the wealthy don’t. Since the “fair tax” is a sales tax, they are taxed on all their income. The wealthy don’t. The wealthy save most of their money so they wind up not only not paying the up to 70% Bernie Sanders would have pushed for, but something close to 0%, depending on how wealthy they are. The wealthier they are, the lower the proportion of their spending is to their net worth. That means they pay a lower percentage of their income than the poor do.

Fair Tax supporters understand that this is unfair to the poor so they made a concession with something called, “prebates.” Prebates are an odd thing coming from Libertarians, as they would amount to the most massive welfare dole out in American history. The reason I call the whole thing a “ploy” is that the dole out not only applies to the poor, but everybody gets a prebate, including your neighborhood billionaire. Pretty much, the prebate is a government hand out that amounts to the amount of money a person needs to spend in a year in order to survive. Or that’s the theory anyway.

Great. We can all survive. Except that the disaster that follows is that the fair tax disincentivizes spending. The more you spend, the greater your tax. The only way for the Middle Class to save any money is by resisting spending. The only way the poor can survive is by resisting spending. Spending is sort of vital for the survival of businesses. Supposedly, this is made up for by not “double” taxing businesses on the wholesale level. Supposedly, prices go down because raw materials and the cost of labor become cheaper. After all, businesses no longer pay out social security or payroll tax. Their only job in the tax collection process is collecting sales tax from customers.

The big losers with the fair tax are the middle class. Anyone who lives pay check to pay check has to spend all their money, not just those under the poverty line. The middle class gets to watch the rich get richer since they don’t spend all their money, while they can’t escape their middle class status no matter how hard they try. If there was ever a tax proposal that represented capitalist exploitation it is the so called “fair” tax. It is a ruse for the poor with its prebate. In actuality, it profits the uber wealthy, removing almost all taxation from them entirely.

Well, if you are a believer in the power of trickle down economics, then great. That’s how to turn on the spigot. As a matter of fact, I have no complaint about that theory myself. I have long advocated that any money saved by capitalist pigs goes into investments because that’s how they grow their money. I have never wavered from pointing out that ultimately all investments fall back to producing goods and services that require labor or equipment and that means jobs. I see that as inescapable. My opinion and support of trickle down economics has never changed.

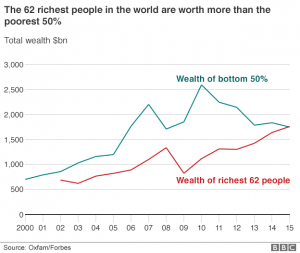

However, capitalist exploitation is not about trickle down. It works in other ways. I see big box companies capitalizing on and encouraging shitty job markets so they can pay minimum wage. I see them quickly turn to part-time-only hiring in order to avoid paying health benefits. I see Wall Street recognizing that and doing something even more dastardly than quantitative easing to suck the blood out of workers. They literally want to make sure that there is always a certain volume of unemployed so they can pay less in labor. They will pay off politicians to make sure there are always at least 7% unemployed.

The old 7%, I mean. They were happy to shift the calculation of the unemployment rate so that what used to be called 17% is now called 5%. When I say 7%, I’m referring to the old 7%. Bring the unemployment rate down below the old 7% and it creates a job seeker’s market. A job seeker’s market is when there are many jobs available and not enough potential employees available seeking them to fill the positions. It becomes too expensive to do business when that happens. Service suffers. In a job seekers’ market, some companies can’t even do business because they can’t find the right employees to stay competitive. They may even have to go out of business.

Forget trickle down economics. Unemployment manipulation is where the real capitalist exploitation is. But that’s another subject. For now let’s examine the fair tax.

There are other perks. The fair tax helps employees by eliminating social security and medicare deductions. It doesn’t matter how many exemptions they have. The only withholding will be for voluntary medical plans, retirement plans and other voluntary employee benefits. I’ve got to be fair about saying this. That’s a major plus for the fair tax. The poor working stiff may pay far more than the uber wealthy proportionately, but dang, they do get a boost in the form of what feels like an initial raise, and they won’t be complaining when they receive those prebates either.

How slick. How insidious. This plan will fail if ever implemented for lack of adequate revenue in an era of prebate fueled hyper-inflation. The problem is not actually on the economy side. It is on the government spending side. Allow me to explain. Let’s start by highlighting some of the other positives in this plan.

First, inflation is not something you complain about when you hold all the comodities and real estate, which is what companies and wealthy people do. Make no mistake, the uber wealthy get uber wealthier with this “fair tax.” They enjoy a free ride on inflation and free themselves of the burden of being taxed all at the same time. Now I have no complaint about people becoming trillionaires. My only concern with that is the way trillionaires push their political weight around and turn countries into plutocracies. But that is a discussion for another day. For now, I should at least point out that knowing this, you can be sure of who it is who is pushing for this type of tax plan.

Second, there is the rest of us. The way the fair tax is designed, everybody expects inflation, because the prices are supposed to increase. That’s exactly what the tax is. It’s worked into the price of everything you buy. You’ve got your prebate subsidizing it. So just don’t buy so much.

Well there’s an interesting conundrum. Buying slows down, and that forces prices down. Money supply increases and that pushes prices up. Which is it? It’s a balance. So I’m going to list here on the positive side that the fair tax is not so inflationary as one might first think. However, saying so requires I temper that by noting that neither does it speed up the economy up. If there is a “balance,” then there is also sluggish growth. So on to the negatives.

The problem with the rich getting richer is not that the rich get richer, it is with the poor getting poorer and the middle class becoming poor with them. With rare exception, neither the poor nor the working class will be able to jump over the canyon to become wealthy. The middle class will become poverty class a heck of a lot more easily. Unless the basic problem of too much unemployment is solved, they will remain one misstep away from the even more inescapable poor house, one job loss, one auto accident, one illness – even just a short term illness.

The fair tax enhances this problem with even more incentive for corruption. Once you boost the existing plutocracy with even more cash, you guarantee the continued corruption of the government. This will ensure that the unemployment rate remains above the old 7% so that there is never a job seekers’ market. In short, the companies fair well, but the poor and the middle class are screwed. This may be something the Libertarians in our midst support, but it is nothing the average American should buy into.

But you may not appreciate or believe in that so let me assure you it gets much worse. As I mentioned, this is a revenue problem. The reality is that the rich presently pay the majority of America’s taxes. That money suddenly doesn’t appear in our tax coffers. The fair tax suddenly shuts off the spigot to the vast majority of its current revenue source – taxes paid by the wealthy. And if that isn’t enough, it also stops taxing corporations. There is no way to make up for this sudden loss and yet maintain a flat tax rate other than to tax the poor and middle class still more. How? By increasing the national sales tax rate. After all, the national sales tax is its only source of revenue – unless … it doesn’t repeal the 16th amendment within the required seven years.

I forgot to mention that. The Fair Tax proposes to eliminate the IRS by repealing the 16th amendment. Repealing amendments isn’t so easy in a partisan world. Let’s be realistic about this. Fair Tax majority support is already fluky. Assuming that after seven years, the IRS comes back and starts recomplicating this, we’ll have both a rapidly escalating national sales tax and the existing mess we’re already complaining about at the same time. Isn’t that wonderful?

THE ESCALATING PREBATE

Did I say “escalating”? Yes, I did … because of the cost of the prebates. These start out at say, $25,000 for a family of four, and the cost of living in a state is not a consideration, (which is certainly unfair). Then, since more money needs to be raised and taxes will increase, the cost of living goes up. The prebate is based on the cost of living. Therefore, the prebate also must increase. The price of products on the shelves that the poor and middle class have to spend all their money on keeps increasing along with the prebate amounts. The prebate amount keeps increasing with higher and higher tax rates. In each case, it is never the wealthy who pay for it. It is always the poor and middle class. And these are made happy by the morphine shots they get that we call prebates. The trick is to keep everybody comfortably numb.

The pot then begins to boil with the poor and middle class unaware that they can jump out of it. At a certain point, the national sales tax rate reaches 100%. This is inclusively calculated, so a product that costs $1.00 on the shelf, gets a 100% or $2 price. No problem. The prebate pays for it. This still doesn’t produce enough income for the government, so the rate then becomes 200%, or 300% and so on. The price of the product on the shelf doubles or triples accordingly every few months or years. Unfortunately, it is not the business that is controlling the price at that point. It is the government. If people can’t afford it and buying slows down, the price can only be reduced with the loss of government revenue. That means the national sales tax rate must increase still more and with it the prebate amount. The circle never ends.

The result is an inflation that does not benefit the wealthy. It merely slows down the economy. So what are we doing with responsible fiscal budgeting here? We are creating a crisis. We begin by paying out the prebate in advance. This is where it gets its name. It’s paid out so that the people can afford the extra cost of stuff. Paying it out in advance is fine for the public, but not for the government, which needs to live within its means. The government doesn’t have the cash to do that unless it goes farther into debt. Yes, the government too can have cash flow problems.

The prebate amount keeps increasing so this problem doesn’t go away. It only escalates. The result is that the government eventually shuts down. Good grief. We were losing money with the current tax system because of loopholes for the wealthy. The fair tax takes the current pin hole sized loop holes and turns them into one big rip in the balloon. Just say “no” to the fair tax. It’s not just unfair. It is suicidal.

THE RESTORATION PARTY TAX POLICY

So enough about the Fair Tax. The Flat Tax is no better. It just doesn’t offer prebates or try to mess with the 16th amendment. Let’s move on to the tax policy of the Restoration Party. What do I actually recommmend?

I said that I liked the neutral tax. Like other tax programs, the neutral tax seeks to abolish the IRS. There is nothing simple about the neutral tax though. It sells itself as simplistic but in fact, I should state up front that it is likely to be far more complex. Its complexity comes from allowing each state to determine its own tax methods. What that does is it creates fifty separate tax codes – one for each state.

It is up to each state how simple or complicated they want to make their revenue generation. The neutral tax says nothing about how to scale revenue between the rich and the poor or what deductions and credits to allow or for what purposes. It allows states the flexibility to build tax revenue code that is in their own best interest, which is something their own voters can determine.

It will be the general policy of the Restoration Party that it is the Federal government’s role to serve the states, just as it is the role of each state to serve its residents. Government is for and by the people. The guiding principle of the Restoration Party is restoring public service to the people, by the people, for the people. That means on every level. The role of the Federal government is no different and its tax policy fits in with that consistent view.

My personal view on this matter is not entirely important. What matters is the opinions of the people in each state. A state that wants to attract the presence of the uber wealthy, may want a Fair Tax code. Then again, its residents may strongly object. One thing the neutral tax does by bringing power back to the states is it takes it out of the hands of the plutocrats in Washington. That does not, however, take it out of the hands of the plutocrats in their state. A much closer attention to local politics can be expected and it won’t be dictated by a news feed controlled by national TV. That could get interesting.

My own state of Florida has no state income tax. Our government gets its revenue primarily from travel and hospitality. Our state sales tax is comparatively low. It was 5% when I grew up and has now crept up to 7%. Property taxes are quite low also and there is a homestead exemption here to encourage people to move here. That raises property values, which raises property tax revenue but no where near as much as a simple increase in property tax rates would.

I personally am a believer in real estate property tax and another type of property tax, a stock and bond property tax. I’m all for the elimination of income tax. But it is property tax I would personally advocate. But that’s just me. Other Restoration Party members might vehemently disagree. The rich may not buy much stuff but they do purchase assets. If you want to tax them, then forget their income. That disincentivizes business growth. Tax their assets instead, starting with their real estate. Sure they’ll squeal and complain, but that’s where the money is. It’s not in the pockets of the poor and the working class who live from paycheck to paycheck.

That’s my opinion and I’m sticking to it. But neither is that the policy of the Restoration Party. I always separate the two. The Party itself let’s each state decide. As such, it makes sense for each state Restoration Party to support the neutral tax. Beyond this, it cries out for a restoration of public service to the people. That means breaking up monopolies and divorcing government from the wealthy few. As such, it is likely that measures separating the wealthy from governmennt influence would be taken. Raising property taxes, and especially stock and bond taxes, would not be inconsistent with that aim.

Simplicity can also be served. I don’t want to undersell this. An asset tax is better, in my opinion, than a capital gains tax. Eliminate a capital gains tax and replace it with an asset tax. I recognize this requires repealing a clause in an amendment. Parties are better suited for making such changes than Acts and bills are in themselves. Excellent change takes time.

Simplicity is also served in a practical way. States have smaller bureaucracies. They tend to live within their means better than the Federal Government does. They know better than to make their tax laws hopelessly complex. The harder that is, the more tax collectors they will need. They can’t afford more tax collectors and auditors. Elimination of tax loopholes is in their best interest. Simplicity follows and each state handles it, all while maintaining incentives that make sense for each state.

Now that is policy that I think belongs on the Restoration Party platform. It’s two visions. One for me and one for the party. This one is for the here and now. And there you have it.